First home buyers in NSW can now choose between paying upfront stamp duty or a smaller annual property tax when buying a property worth up to $1.5 million.

This is known as the First Home Buyer Choice and was brought in by the state government to help more people break into the market by lowering the upfront costs of purchasing property.

Treasurer Matt Kean said opting for the ongoing property tax will shave around two years off the time needed to save for a deposit and should see the majority of eligible first home buyers pay less tax overall.

Here’s everything you need to know about the First Home Buyer Choice.

How the scheme works

From 16 January 2023, eligible first home buyers who opt into the tax will pay an annual payment based on the land value of the purchased property. The property tax rates for 2022-23 will be:

- $400 plus 0.3% of land value for properties whose owners live in them

- $1,500 plus 1.1% of land value for investment properties

Existing stamp duty exemptions and concessions will continue – as will the First Home Owner Grant.

This means you will still be exempt from stamp duty if you buy a new or existing home worth up to $650,000, so won‘t need to opt into the property tax.

For those buying a property above $650,000 and below $800,000, you’ll still have the option of receiving a concessional rate of stamp duty, so will have to do the sums to see which works out in your favour.

You can use the state government’s First Home Buyer Choice calculator to do this. Alternatively, you can get help from an expert mortgage broker like Just Imagine Finance.

What happens when you sell the property?

Only first-home buyers are eligible to pay the property tax. So all other purchasers will continue to pay stamp duty as normal.

How to decide between paying stamp duty or the property tax

Stamp duty might be a large, upfront payment – but you only have to pay it once. By contrast, the property tax will be levied every year until you no longer own the property.

This means, to make an informed choice between the two, you need to first consider how long you intend on staying in the property.

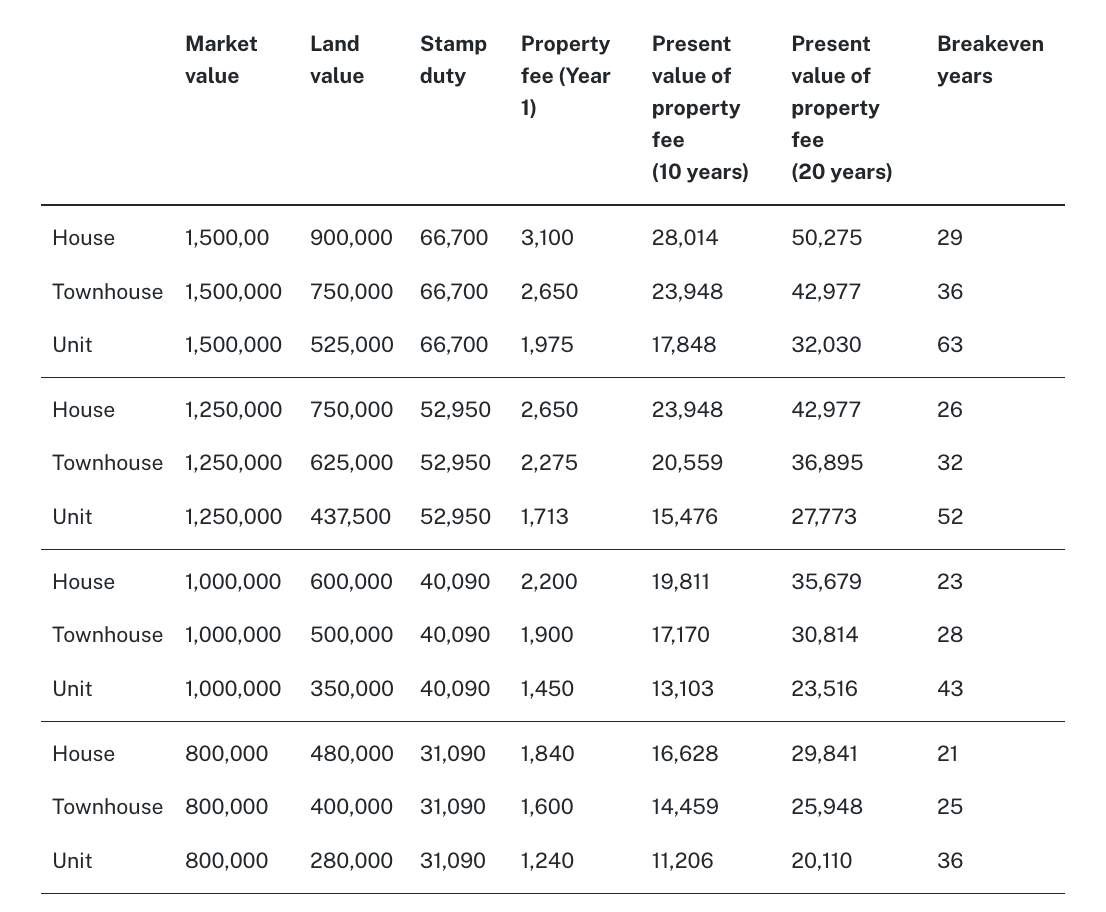

NSW Treasury modelling shows an owner-occupier buying a $1 million house would currently pay $40,090 in upfront stamp duty. Opting for the property tax would see them pay $2,200 in their first year. More importantly, they would need to stay in the property for 23 years before the amount they paid in property tax equalled the upfront stamp duty.

The average hold time in NSW is 10 years.

More stamp duty and property tax comparisons are in the table below.

Looking to get on the property ladder in 2023? Just Imagine Finance can help you make the most of federal and state government incentives. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.