Over the long-term, Australian property prices have enjoyed incredible growth – and new research suggests that growth is likely to continue over the next year.

First, let’s do a quick history lesson, to illustrate just how much house prices have skyrocketed over the past 50 years.

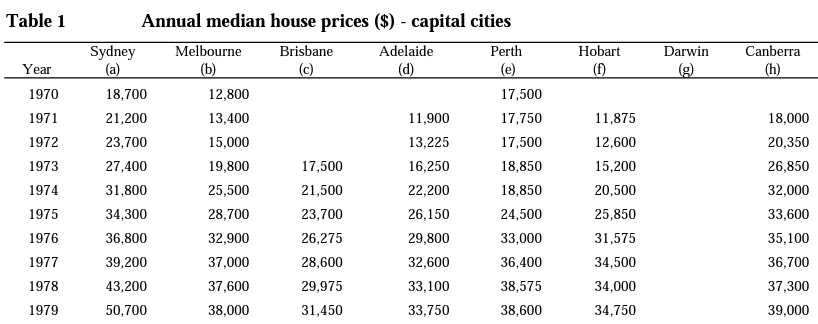

Back in 1973, the median house price in Sydney was only $27,400, while it was even lower in the other capital cities, according to data from Peter Abelson and Demi Chung at Macquarie University.

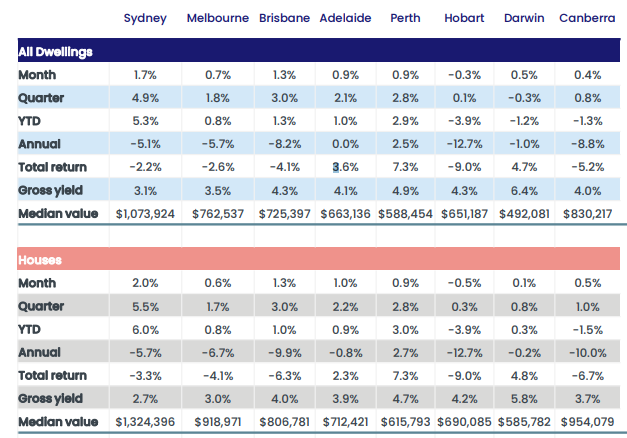

Now, if you look at the bottom half of the CoreLogic chart below, you’ll see that median house prices as of June 2023 range from $586,000 in Darwin to $1.32 million in Sydney.

While past performance is no guarantee of future performance, there are two good reasons to think property prices will continue to increase over the coming decades.

First, by the standards of developed countries, Australia has strong population growth. All those extra people will need somewhere to live – and the supply of new properties is not keeping up with the demand for accommodation. That is likely to put upward pressure on property prices in the years ahead.

Second, incomes are likely to keep rising. Average hourly wages increased 113% over the 25 years to March 2023, according to the most recent data from the Australian Bureau of Statistics. As technology continues advancing and our workforce continues to become more productive, salaries should continue rising. If that happens, buyers will have more money to spend on property.

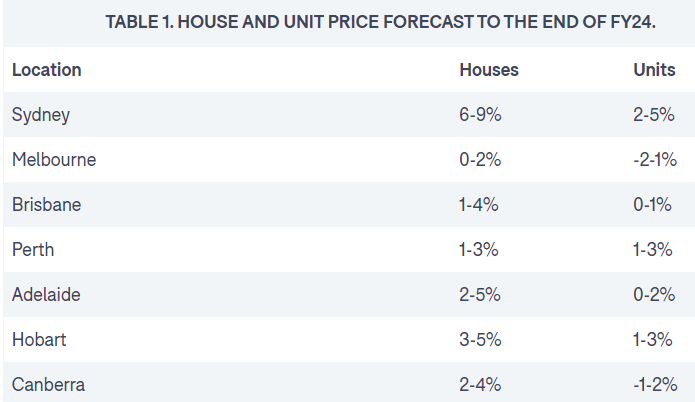

Domain forecasts price growth in 2023-24 financial year

But that’s the long-term. Focusing just on the short-term, prices are also expected to rise.

For the 13-month period from 1 June 2023 to 30 June 2024, Domain has forecast that house prices will increase in every capital city and unit prices will increase in most.

Two main factors are driving this expected increase in property prices – a fast-rising population (demand) and a slow-rising housing pool (supply).

“Population pressures will drive housing demand and property prices higher, particularly with the momentum in lifting temporary and permanent visa grants to alleviate skills shortages,” according to Domain.

“This is occurring at a time the construction industry has experienced unprecedented headwinds – skills shortages, supply chain disruptions, and soaring construction costs. Higher construction costs have created an industry-wide slowdown and could eventually feed into higher property prices – with pre-existing housing under-supply worsened as a result.”

That said, the interest rate increases we’ve experienced over the past year will limit this price growth, by reducing the average buyer’s borrowing power and therefore the amount they can bid on a property, according to Domain.

We can help you enter the market

If Domain is right and prices end up being higher this time next year, that would suggest now is a good time to enter the market – assuming, of course, your personal circumstances allow.

It’s also worth remembering that if property prices grow strongly over the decades ahead, as they have in the past few decades, a house or unit you buy today could be worth significantly more in the future.

At Just Imagine Finance, we can use our experience to compare home loans, recommend a great loan and manage the application process, whether you want to buy your first home or use equity from your existing home to buy an investment property.

As mentioned earlier, the average person’s borrowing power has fallen in the past year. But your borrowing power can vary from lender to lender – sometimes by hundreds of thousands of dollars – which means we can recommend a lender that is likely to look favourably on someone with your scenario.

Contact us on catherine@justimaginefinance.com.au or 0414 673 359 if you’d like to enter the market or discuss your options.