In August, the Reserve Bank of Australia (RBA) left the country’s official interest rate unchanged at 4.10% to give the central bank more time to assess the state of the economy.

This is the second straight month there’s been a pause, the longest break since the RBA started raising rates in May 2022.

During this time, there have been 400 basis points worth of tightening, marking one of the fastest hiking cycles on record as the central bank acts to tame inflation.

Higher interest rates appear to be having their intended effect and slowing the economy, with the Australian Bureau of Statistic’s most recent consumer price index showing annual inflation eased to 6.0% in the June quarter from 7% in the March quarter.

Sadly, though, that’s still more than double the RBA’s target range of between 2-3%.

As such, in the statement accompanying the decision, RBA governor Dr Philip Lowe left the door open for more interest rate hikes.

“Some further tightening of monetary policy may be required to ensure that inflation returns to target in a reasonable timeframe, but that will depend upon how the economy and inflation evolve,” he said.

“The board remains resolute in its determination to return inflation to target and will do what is necessary to achieve that.”

The RBA’s next move will be down: Westpac

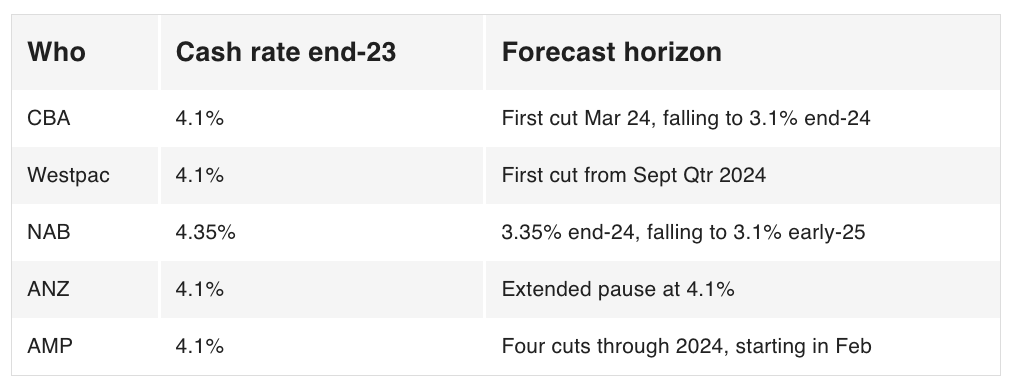

Despite Dr Lowe’s warning, a growing number of economists believe we’ve reached the peak of the tightening cycle – including three of the four major banks (see PropTrack table below).

Westpac chief economist Bill Evans said that he expects the RBA’s next move to be down – though slightly later than originally forecast.

“The next challenge for the outlook should now be the timing for the beginning of the easing cycle. When Westpac was forecasting rate hikes in both August and September we were comfortable with the cycle beginning in the June quarter of 2024,” he said.

“That timing now looks more likely to be in the September quarter 2024 when we expect the unemployment rate to be nearing 5% and inflation in the 3–3.5% range.”

Commonwealth Bank and NAB have also pencilled in cuts for next year.

What does this mean for the property market?

No one knows for sure if we’re out of the woods yet as that, ultimately, depends on how the economic data plays out in the coming months. That said, if we’re not at the peak, it’s likely we’re very close – with Dr Lowe recently telling the House of Representatives standing committee the “worst is over”.

CoreLogic executive research director Tim Lawless believes that, in turn, is restoring confidence to the property market as consumers see the light at the end of the tunnel.

“Consumer confidence and housing activity go hand in hand. Generally, when sentiment is low, home sales are low and vice versa; so, any lift in sentiment is likely to be accompanied by a rise in active buyers and sellers,” he said.

What’s more, national home values have been rising since March, despite higher interest rates as a supply/demand imbalance puts upwards pressure on prices.

Many commentators and economists predict the rebound will continue, including major banks NAB and Westpac. Westpac has tipped national price growth of 7% for 2023, while NAB is forecasting annual growth of 4.7%.

Whether you’re buying your first or second home to live in or rent out, Just Imagine Finance can help you get the right home loan. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.