A record number of Australians are approaching mortgage brokers, rather than banks, for their home loans.

Between July and September 2021, mortgage brokers originated 66.9% of all new home loans, according to the latest data from research group Comparator.

That 66.9% figure is a record market share for brokers.

By way of comparison, brokers originated 60.1% of all new home loans in the September 2020 quarter and 54.9% in the September 2019 quarter.

There are three main reasons why a majority – and a growing majority – of Australians are choosing brokers over banks:

- Brokers offer more choice than banks

- Brokers deliver better service than banks

- Brokers are bound by the Best Interests Duty, while banks aren’t

Brokers offer more choice than banks

When you approach your bank for a home loan, the person you speak to will recommend products from only one lender – their own – even if they know another institution could offer you a comparable loan with a lower interest rate or lower fees or better features.

But when you visit a mortgage broker, the broker will compare loans from numerous lenders on your behalf.

For example, Just Imagine Finance works with lenders of all shapes and sizes, including the big four banks, challenger banks, credit unions and non-bank lenders. Instead of trying to force you to take out a loan from just one institution, we take the time to understand your financial position and recommend a loan that suits your unique circumstances.

By the way, don’t believe the common misconception that because you’ve been a loyal customer of your bank for many years, they’ll reward you with a special deal. Banks don’t give loyal customers better deals. In fact, the data shows that banks actually give better deals to new customers.

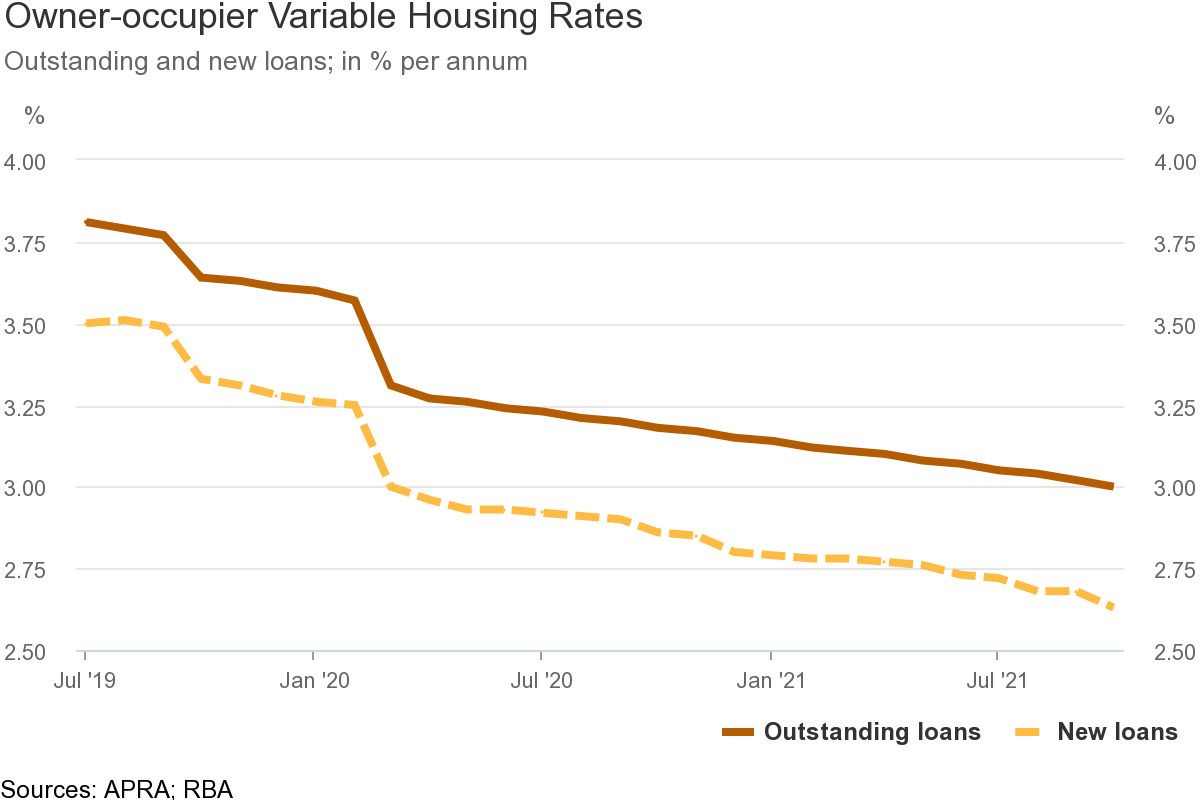

For proof, check out the graph below from the Reserve Bank of Australia, which shows interest rates for owner-occupiers with variable-rate home loans. At the end of October:

- Existing customers (top line) were charged an average of 3.00%

- New customers (bottom line) were charged an average of 2.63%

Why were new customers charged an average of 0.37 percentage points less than existing customers? Because lenders know they have to fight hard to win new customers, which is why they tend to offer them special deals.

The message is clear: banks aren’t loyal to borrowers, so borrowers shouldn’t be loyal to banks. Instead, they should shop around – and a mortgage broker can help them do that.

Brokers deliver better service than banks

There are some excellent bank staff out there. But brokers tend to deliver better service.

Why? Because bank staff tend to be employees, whereas brokers tend to be business owners. That means brokers have a stronger incentive to turn their clients into customers for life, which means they’re likely to try harder.

Brokers are bound by the Best Interests Duty, while banks aren’t

Since the start of 2021, mortgage brokers have been bound by the Best Interests Duty, which requires them to always act in the best interests of their clients. As the regulations state: “If there is a conflict of interest when providing credit assistance, you are required to give priority to the consumer’s interests. You must not prioritise your own interests or the interests of credit providers or third parties.”

Banks, on the other hand, don’t have to follow the Best Interests Duty. That’s why they’re allowed to recommend loan products from their own institution, even if they know customers could get a better deal elsewhere.

Want to buy a property or refinance an existing loan? Just Imagine Finance can help you compare loans from a wide range of lenders. To discuss your options, contact Catherine at catherine@justimaginefinance.com.au or 0414 673 359.