The great Australian dream of homeownership has been given a boost after both the federal Coalition government and Labor opposition unveiled property incentives designed to tackle the housing affordability problem.

This is after national prices climbed by 33.3% since the pandemic, taking the median home price from $554,000 in March 2020 to just under $740,000 in March 2022, according to CoreLogic.

It’s a similar story in Katoomba, where asking prices for houses have surged by an astonishing 39.3% to $958,000 over the same period, according to SQM Research.

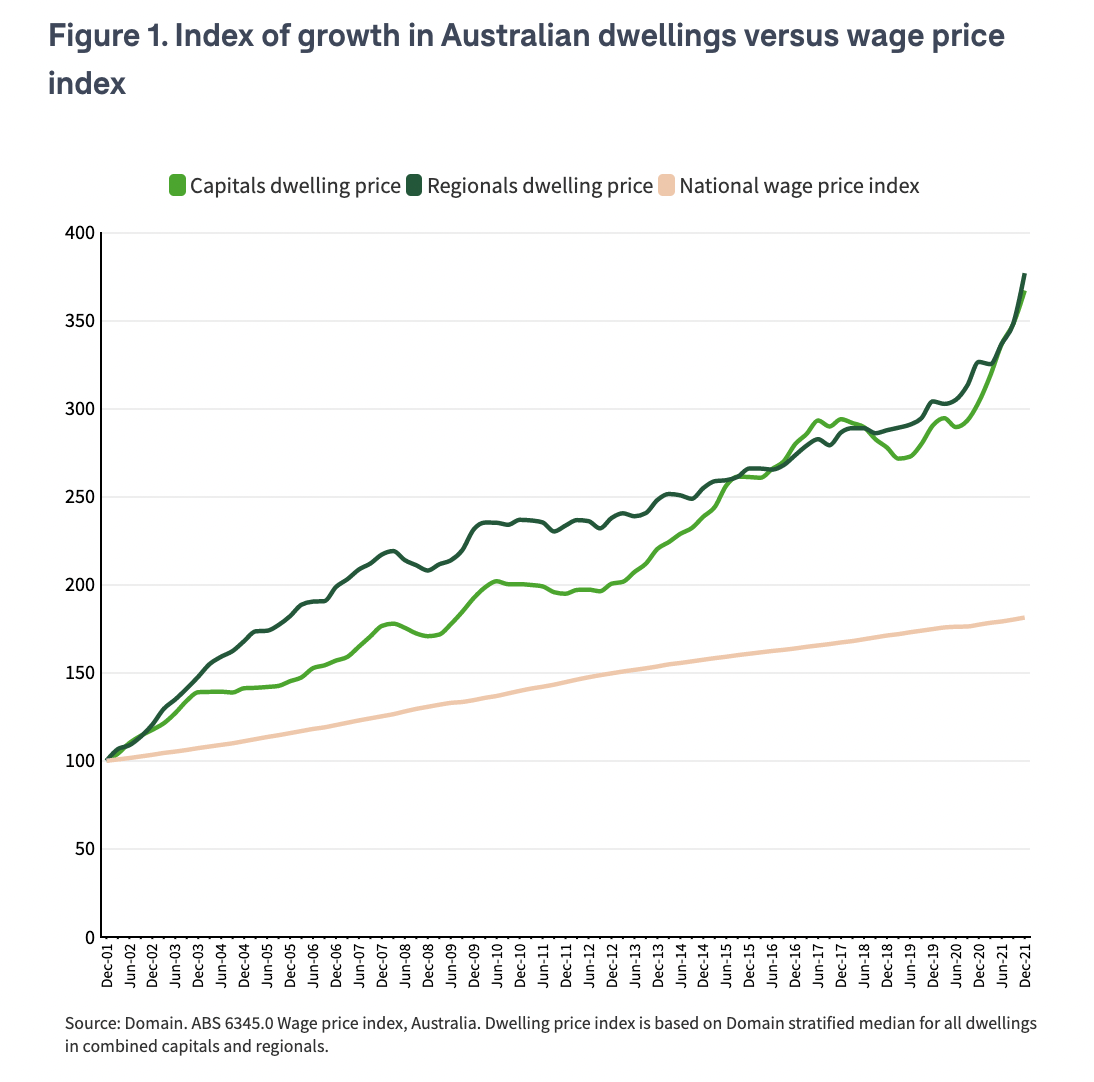

The problem is, wages haven’t kept up with these skyrocketing prices – as the Domain chart below clearly shows.

Domain’s 2022 First Home Buyer Report estimates it would take a young couple on an average income eight years and one month to save a 20% deposit for a Sydney house worth $900,000.

So what are our politicians’ plans to help aspiring homeowners break into the property market?

Labor’s regional first home buyer support scheme

First out of the blocks was Labor, which promised to help regional first home buyers if they win the elections in May.

Under Labor’s proposals, the scheme would help 10,000 first home buyers a year in regional Australia buy a home with a deposit of just 5%. That’s because the government would guarantee up to 15% of the value of the property purchased – helping the buyer avoid paying lender’s mortgage insurance (LMI), saving them up to $32,000.

There are conditions, of course. First home buyers would need to:

- Be owner-occupiers, not investors

- Have a taxable income no higher than $125,000 per year for singles and $200,000 a year for couples

- Have been living in the region for at least 12 months

The price of the property would also be capped at:

- $800,000 in the Illawarra, Central Coast and Newcastle

- $600,000 in other parts of regional NSW

The Coalition’s plans

Not to be outdone, the Coalition matched Labor’s pitch with a similar scheme announced in the 2022 federal budget.

From October this year until 30 June 2025, the Coalition’s Regional Home Guarantee (RHG) would also help 10,000 aspiring homeowners a year purchase property in regional Australia with only a 5% deposit.

However, the RHG would not just be limited to first home buyers, but also open to those who have not owned a home in the last five years.

On top of the new regional initiative, the federal government is also expanding its:

- First home buyer schemes from 20,000 to 35,000 places per year, from 1 July 2022. These schemes allow first home buyers to purchase a property with just a 5% deposit without having to pay LMI.

- Family Home Guarantee to 5,000 places available every year until 2025 (up from 5,000 spots available over four years). This scheme allows single parent borrowers to buy a home with just a 2% deposit while avoiding LMI.

Looking to break into the property market? Just Imagine Finance can help. To discuss your options, contact Catherine at catherine@justimaginefinance.com.au or 0414 673 359.