First home buyers in regional areas are being given a helping hand from the federal government, thanks to the launch of the Regional First Home Buyer Guarantee on October 1.

Usually, when you apply for a home loan with less than a 20% deposit, you need to pay lender’s mortgage insurance (LMI) – which can add up to tens of thousands of dollars.

However, under the scheme, the federal government will guarantee up to 15% of the property’s purchase price. As a result, you can break into the market with a deposit of as little as 5% without having to pay LMI.

There are 10,000 places available each financial year until 30 June 2025.

What are the eligibility requirements?

To be eligible, home buyers (or at least one borrower when applying as a couple) must have lived in the regional area, or adjacent regional area they intend to purchase in, for at least a year before executing their home loan agreement.

You also need to:

- Be an Australian citizen over 18

- Be a first home buyer who has not previously owned, or had an interest in, a property in Australia

- Be an owner-occupier, not an investor

- Earn up to $125,000 (individuals) or $200,000 (couples)

- Provide your Notice of Assessment for your taxable income for the 2021-2022 financial year

What are the price caps for regional properties?

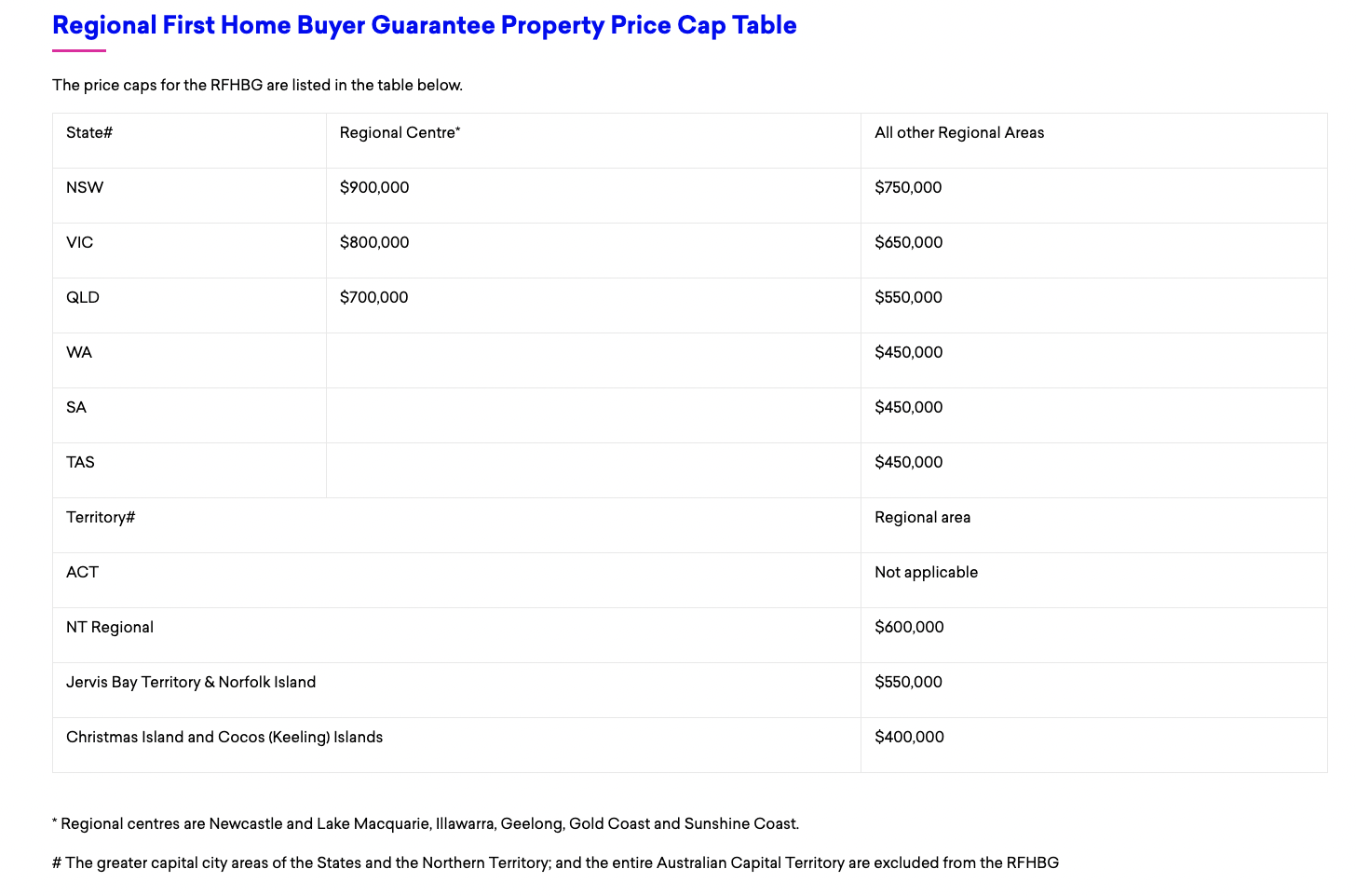

While you can buy a range of residential properties, including existing dwellings, off-the-plan units or a house-and-land package, you need to make sure the purchase price is under the property price threshold for the region.

These are shown in the table below.

What other federal government schemes are there?

Besides the Regional First Home Buyer Guarantee Scheme, two other federal housing schemes help you buy a home with a small deposit while avoiding LMI:

The First Home Guarantee

Formerly known as the First Home Loan Deposit Scheme, the First Home Guarantee helps eligible first home buyers purchase a home with a deposit of as little as 5%.

Eligibility requirements are similar to the Regional First Home Buyer Guarantee with one big difference: there are no location restrictions, so you can buy anywhere in Australia, including the capital cities.

This financial year (up until 30 June 2023) there are 35,000 places available for eligible first home buyers.

The Family Home Guarantee

This scheme helps single parents with dependants buy or build a new home with a deposit of as little as 2% of the property value. Unlike other federal schemes, eligible participants can either be first home buyers or previous owners (who don’t currently own property).

When the scheme first launched, there were a lifetime total of only 10,000 spots available. However, as of 1 July 2022, there will be 5,000 additional places per year.

How a mortgage broker can help

Given how challenging it can be to save a deposit for your first home, it’s great news that these federal government schemes exist.

However, as you can see, they regularly change over time, so it can be difficult to keep track of their requirements. That’s where an expert mortgage broker like Just Imagine Finance can help.

We’ll help you determine if you are eligible for government assistance, explaining all the rules to you in plain English and holding your hand throughout the process.

First home buyer hoping to get on the ladder? Just Imagine Finance can help. Contact Catherine on 0414 673 359 or catherine@justimaginefinance.com.au