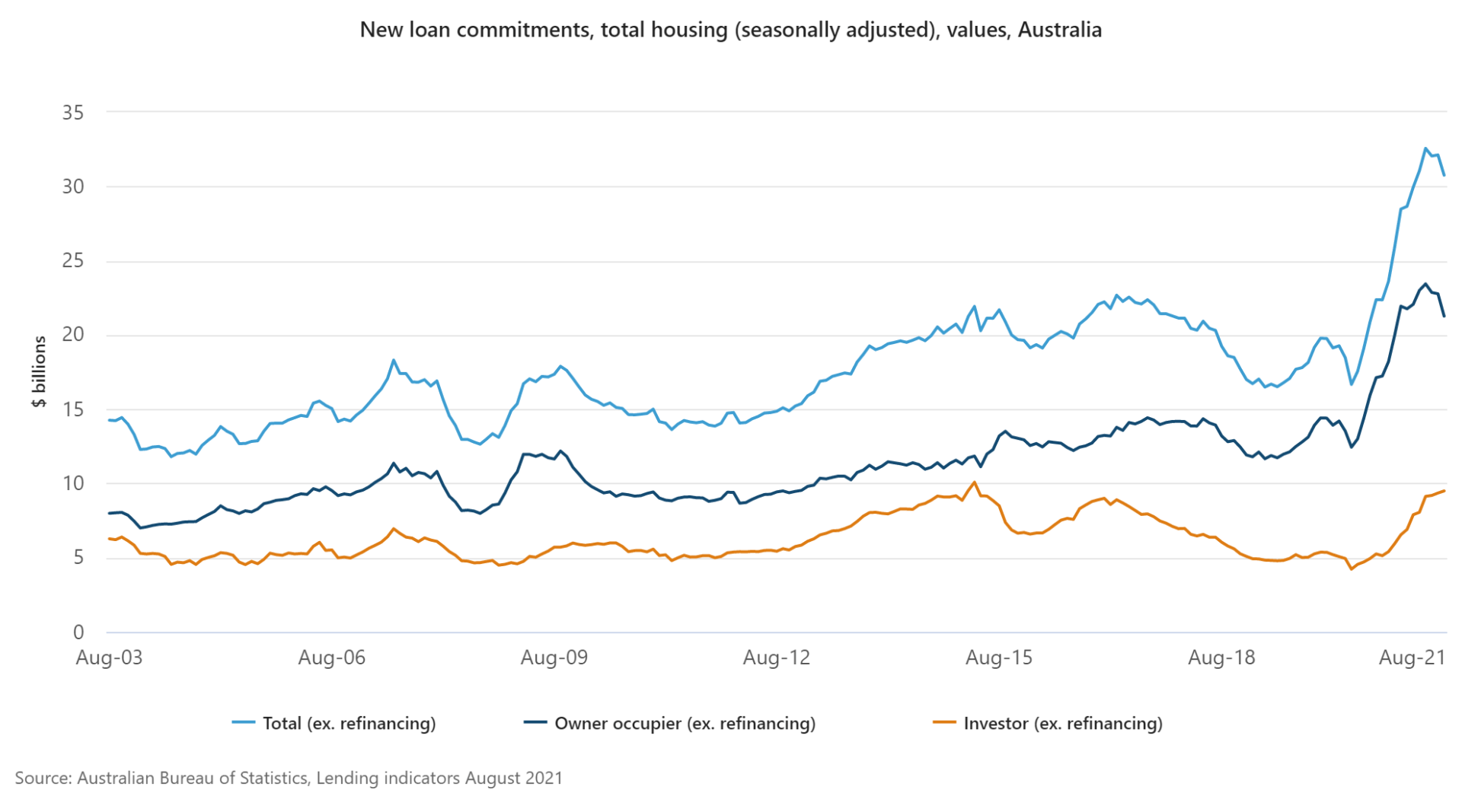

Property investors are piling back into the market right now, with investor home loan activity at near-record levels.

Investors took out $9.5 billion of home loans in August, according to the most recent Australian Bureau of Statistics data. That was:

- The third-highest figure in history

- 92.2% higher than the previous year (see chart below)

- The tenth consecutive month in which investor activity had increased

What’s more, the Property Investment Professionals of Australia’s Annual Investor Sentiment Survey found:

- 62% of investors believe now is a good time to invest in residential property

- 35% of investors intend to purchase a property in the next six to 12 months

Why are investors so bullish right now? For four main reasons:

- Interest rates are at record-low levels

- Australia’s median property price grew by a staggering 20.3% in the year to September, according to CoreLogic

- National house rents surged in the year to September, according to SQM Research, jumping 15.4% for houses and 8.4% for units

- The national vacancy rate is at the lowest level since 2011, according to SQM Research

So if you also want to invest in property right now, no one could blame you.

Just make sure you do your research first – and avoid these five common mistakes.

1. Borrowing too much

It’s good to be ambitious. But it can be a mistake to borrow so much money that you don’t leave yourself any margin of error. It’s important to have financial buffers in place so you can cope if interest rates rise, you lose your job or you suddenly have to pay a large bill.

2. Buying with your heart rather than your head

Buying an owner-occupier property is as much of an emotional decision as a financial one. But buying an investment property should be purely about the numbers. This is not somewhere you’re going to live – it’s purely an economic asset. So when you research what type of property to buy and in what location, use your head rather than your heart.

3. Buying in the wrong location

If you look at the averages, Australian real estate has enjoyed impressive capital growth over the long-term. But averages hide a wide range of different individual results. Over the next 30 years, some markets will perform much more strongly than others. Your challenge is to buy in one of these good areas, not to invest in a dud location.

(Just Imagine Finance is happy to refer you to an excellent buyer’s agent, who can help you find a quality property in a location with long-term growth potential.)

4. Buying the wrong property

Identifying a location with strong long-term growth potential is an important first step – but it’s not the only step. You also need to find the right property in the right location. Just as some suburbs grow at different rates than others, so do some properties. As a general rule, it’s often a good idea to steer clear of mass-produced properties, as these tend to record slower price and rental growth than properties with some sort of scarcity value.

5. Cross-collateralising your loans

Congratulations if you’re ready to buy your second investment property. Just make sure you think long and hard about cross-collateralising your loans, because while there are some instances in which this can be a good idea, it’s generally something to be avoided. Cross-collateralising is when one mortgage is secured by multiple properties (as opposed to the standard practice of one mortgage, one property). The reason this is often a bad idea is because, in the future, it might be harder to refinance and your borrowing power might be reduced.

Want to buy an investment property? Just Imagine Finance has helped many investors over the years. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.