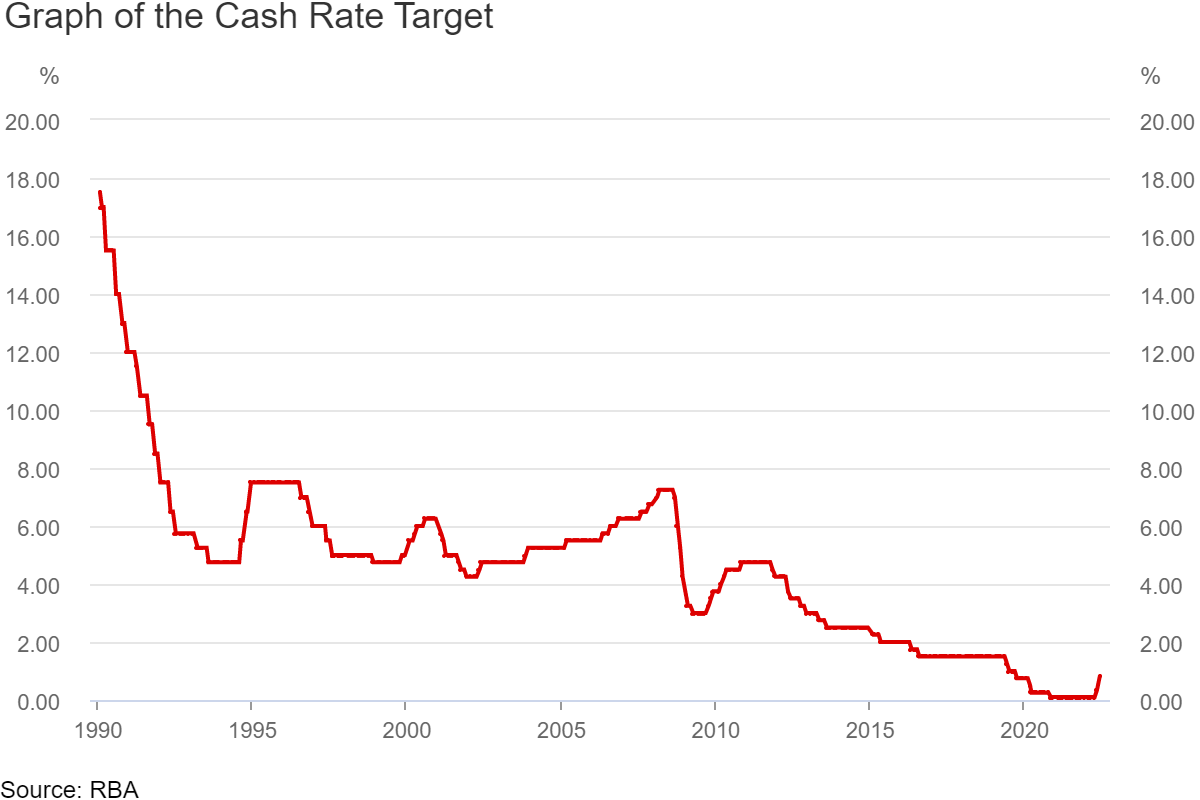

The Reserve Bank of Australia went bang-bang in May and June, raising the cash rate first from 0.10% to 0.35% and then to 0.85%.

Sadly, it’s almost certain that more rate rises are in store, with the RBA recently signalling that the cash rate might rise to 1.75% by the end of 2022 and 2.50% by the end of 2023.

As that happens, we can expect to see higher interest rates for home loans, car loans and business loans.

The reason the RBA is now ‘tightening monetary policy’ (to use the technical term) is because:

- The more expensive it is to borrow money, the less borrowing that will occur

- The less borrowing that occurs, the less economic activity that will occur

- The less economic activity that occurs, the less inflation that will occur

In other words, the RBA is raising the cash rate to put downward pressure on inflation.

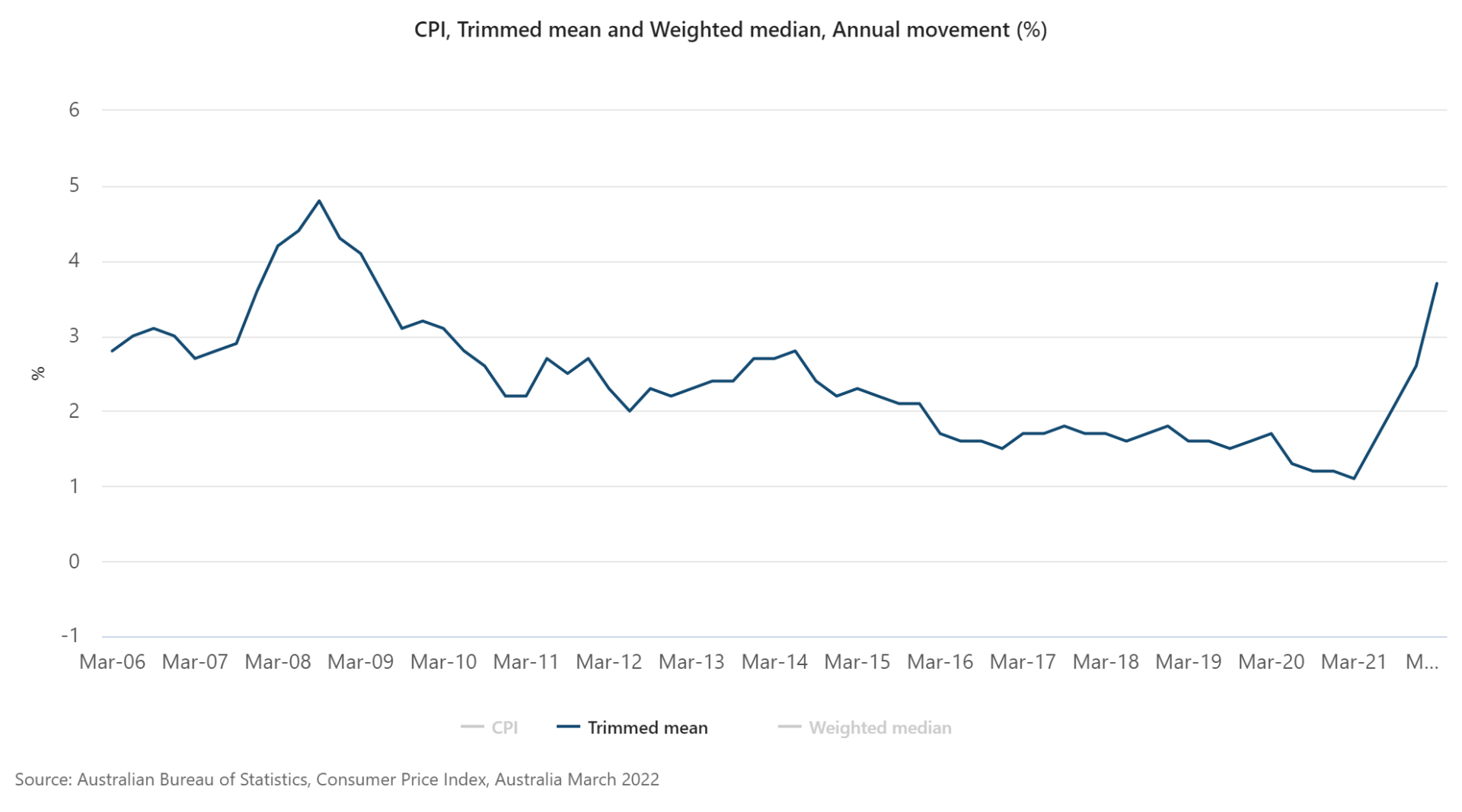

Part of the Reserve Bank’s role is to keep underlying inflation (also known as trimmed-mean inflation) sustainably between 2-3%. Lately, though, underlying inflation has escaped that target range, rising from 1.1% in the March 2021 quarter to 3.7% in the March 2022 quarter – with many economists tipping it to rise further in the next quarter.

Rates won’t keep rising forever

As a result, the RBA is highly likely to keep increasing the cash rate.

Here’s how high the big four banks expect it to reach:

- Commonwealth Bank = 2.10% by December 2022

- Westpac = 2.35% by February 2023

- NAB = 2.35% by December 2022

- ANZ = 3.00% by December 2022

No one likes paying more on their mortgage. But there are a couple of things to bear in mind.

First, the RBA takes no pleasure in hiking the cash rate, and will do so only until it believes underlying inflation has sustainably returned to its 2-3% target range.

Second, the cash rate is starting from a record-low base, and even if it reaches the 3.00% level predicted by ANZ, it will still be low by historical standards.

How to cope with rising rates

Just because home loan rates are increasing across the board, it doesn’t mean there aren’t ways you can lessen the impact of these rate rises.

Here are three ideas:

- Refinance to a home loan with a lower interest rate – so future rate rises start from a lower base

- Use an offset account or redraw facility – so you reduce the share of your home loan that accrues interest

- Make extra repayments – so you pay off more of your mortgage when rates are lower and have less to repay when rates are higher

There’s one other point worth mentioning – don’t panic.

If you took out a home loan before October 2021, your lender would have assessed your application not on the actual interest rate but on that interest rate plus a buffer of at least 2.50 percentage points. Since October, applications have been assessed with a buffer of at least 3.00 percentage points. That means you wouldn’t have qualified for a home loan unless your lender expected you to cope with rising rates.

That said, it might be smart to reduce your discretionary spending and increase your savings, so you’re prepared for future rate rises.

If you’re worried about interest rate rises, Just Imagine Finance can help. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.