As a first home buyer, rising interest rates can be a double-edged sword.

On the one hand, after the Reserve Bank of Australia started its latest ‘tightening’ cycle in May, property price growth has noticeably cooled – and even gone backwards in some markets. Naturally, any falls in property prices make it easier for you to get on the ladder as it lessens the deposit hurdle.

On the other hand, when interest rates start to rise, borrowing money becomes more expensive. That not only increases the size of your monthly repayments, it can also decrease the amount of money a lender will let you borrow in the first place.

This is known as your borrowing power or borrowing capacity.

Don’t panic, though. Your borrowing power is determined by your personal circumstances and varies between lenders, so there are several things you can do to increase it.

We’ll discuss those later on in the blog. First, though, let’s look at how rate rises affect borrowing power.

Understanding borrowing power

When you apply for a loan, the lender assesses your ability to make repayments based on your:

- Income

- Debts

- Living expenses

- Credit score

- Deposit size

The lender will also look at the interest rate you’ll get charged when they assess your borrowing power, adding a safety net (known as a serviceability buffer) of 3 percentage points. This is to make sure you could still pay back the loan should interest rates climb.

As a result, assuming all else remains constant, the amount of money you can borrow against your income naturally falls when rates rise.

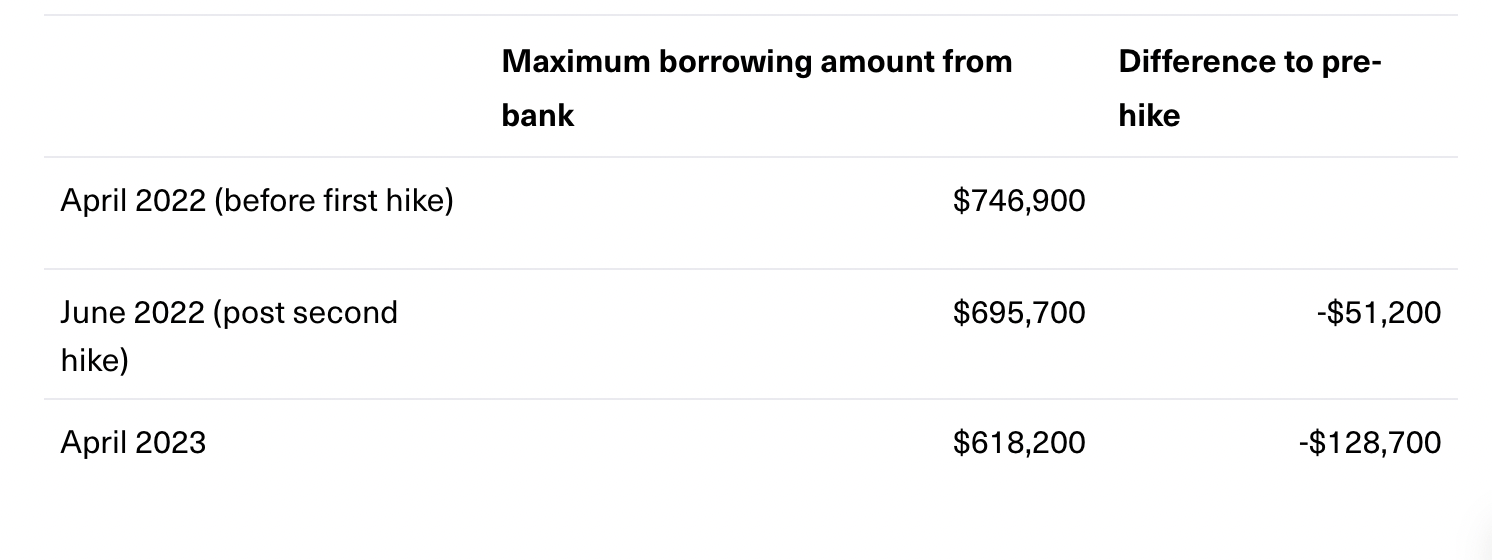

The impact of this can be quite significant, with RateCity estimating that if the official cash rate rose to 2.35% by April 2023 (in line with Westpac’s forecasts), a family of four on a combined annual income of $150,000 would be able to borrow around $163,500 less (when compared to before the rate hikes began).

As the table below shows, a single person, earning $100,000 before tax with no dependents and no debts, could see their borrowing capacity fall by $128,700.

How to boost your borrowing power

There are lots of variables in play when a lender calculates your borrowing power, which means there are steps you can take to improve yours:

- Increase your income – The more you have coming in each month, the more room there will be in your budget for home loan repayments

- Reduce unnecessary spending – The less you spend, the more income you have for mortgage repayments

- Reduce your credit card limit – Lenders calculate your borrowing power based on your access to credit, not your actual balance, so it’s a good idea to cancel cards you don’t use and reduce limits on the ones you do

- Pay off existing debts – The less debt you have, the easier it will be for you to juggle your home loan repayments

- Improve your credit score – A good credit shows the lender you’re a responsible borrower, which both increases your chances of approval and makes it more likely you’ll qualify for a lower rate

- Put down a larger deposit – Having a larger deposit reduces the risk to the lender, so they’ll be more likely to lend you a bigger sum

Finally, one of the easiest ways to improve your borrowing capacity is to work with an expert mortgage broker such as Just Imagine Finance. That’s because your borrowing capacity can vary from lender to lender. A good mortgage broker knows these nuances, so can match you to the right lender for your individual situation.

Looking to boost your borrowing power? Just Imagine Finance can help. Contact Catherine on 0414 673 359 or catherine@justimaginefinance.com.au