Ever heard of the ‘loyalty tax’? This is something far too many borrowers pay. And it’s very costly.

The loyalty tax is the extra interest a borrower gets charged because they remain loyal to their current lender and stick with a higher-priced home loan, despite having the option to refinance to another lender offering a comparable loan with a lower interest rate.

That interest rate differential could add up to thousands of dollars per year and tens of thousands (or even hundreds of thousands) of dollars over the life of the loan.

There are three main reasons borrowers pay the loyalty tax:

- Misguided loyalty – they think that if they’re loyal to their bank, their large, profit-driven bank will be loyal to them

- Lack of knowledge – they don’t realise there are better options available

- Lack of time – they think it will be too time-consuming to refinance

Before we explain why you shouldn’t let those three reasons hold you back from switching to a better loan, let’s explore the loyalty tax in more detail.

Why the loyalty tax exists

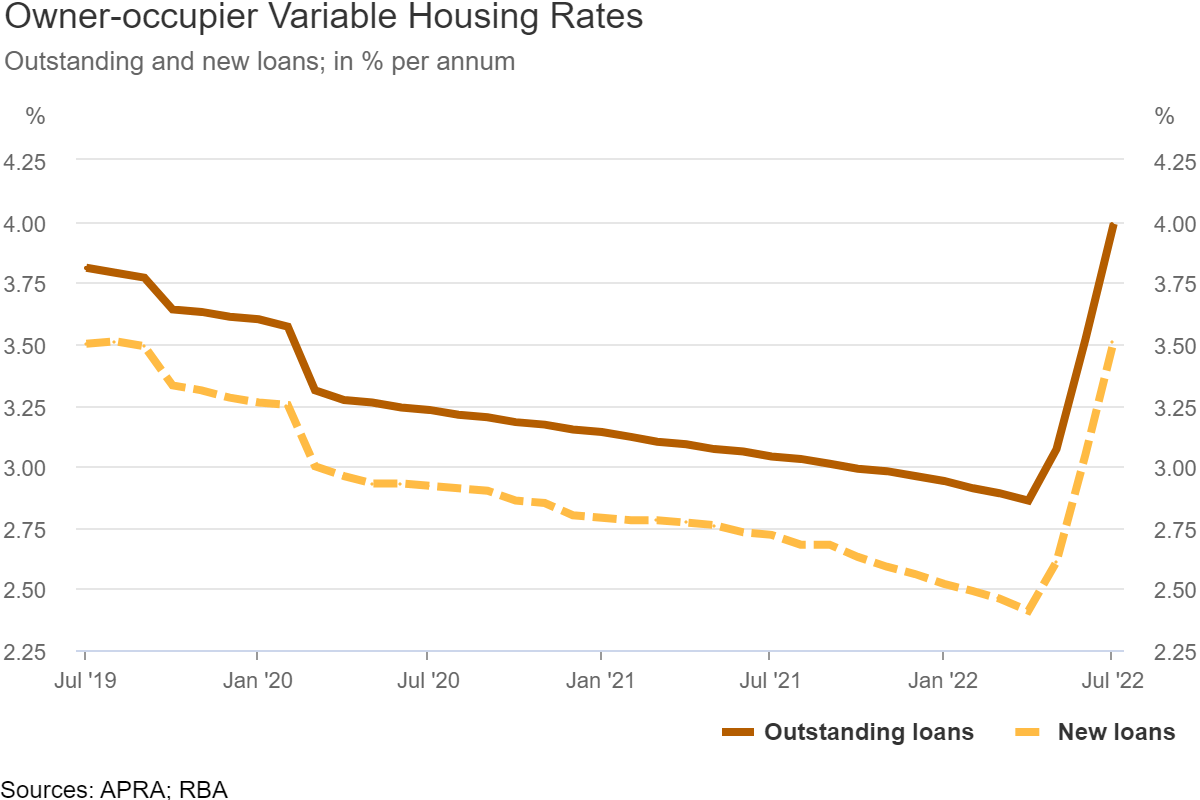

The graph below, from the Reserve Bank of Australia, tells you everything you need to know about the loyalty tax.

As of July, the most recent month for which is data, average interest rates for owner-occupiers with a variable home loan were:

- 3.99% for existing customers (top line)

- 3.51% for new customers (bottom line)

In other words, banks were charging loyal customers an extra 0.48 percentage points in interest.

The mortgage market is fiercely competitive, so lenders know they need to offer low interest rates to win new business. At the same time – due to the three reasons mentioned above – lenders are happy to slug loyal borrowers with higher rates, because they know many of them are willing to pay the loyalty tax.

How to stop paying the loyalty tax

If you want to avoid the loyalty tax, speak to a good mortgage broker, like Just Imagine Finance.

Your broker can approach your lender on your behalf and ask for a discount. If the lender says no or doesn’t provide a large enough discount, your broker can then refinance you to a better home loan.

That brings us back to the three main reasons borrowers pay the loyalty tax, and why those reasons shouldn’t deter you from refinancing:

- Loyalty to your bank shouldn’t hold you back – because if your bank is going to be disloyal to you by charging you higher interest rates than new customers, there’s no reason why you should be loyal in return

- Lack of knowledge shouldn’t hold you back – because you don’t need to know about all the other home loan options in the market; that’s your broker’s job

- Lack of time shouldn’t hold you back – because your broker will do most of the work for you

Refinancing does involve some effort and there is an upfront cost. But it could deliver you massive savings over the life of the loan.

The alternative is to keep paying the loyalty tax and let your bank grow richer at your expense.

Worried you might be paying the loyalty tax? Just Imagine Finance can let you know if you’re able to switch to a comparable loan at a lower interest rate. Contact Catherine on 0414 673 359 or catherine@justimaginefinance.com.au