It’s official: buying your first home has never been more challenging.

Before we share the data, please bear in mind an important point – there are ways to get on the property ladder a lot faster than these statistics suggest.

According to the most recent 2022 ANZ CoreLogic Housing Affordability Report, from March 2022, the median national property price is now 8.5 times higher than the median national household income, thanks to the recent property boom.

That’s up from 6.8 times at the start of the pandemic.

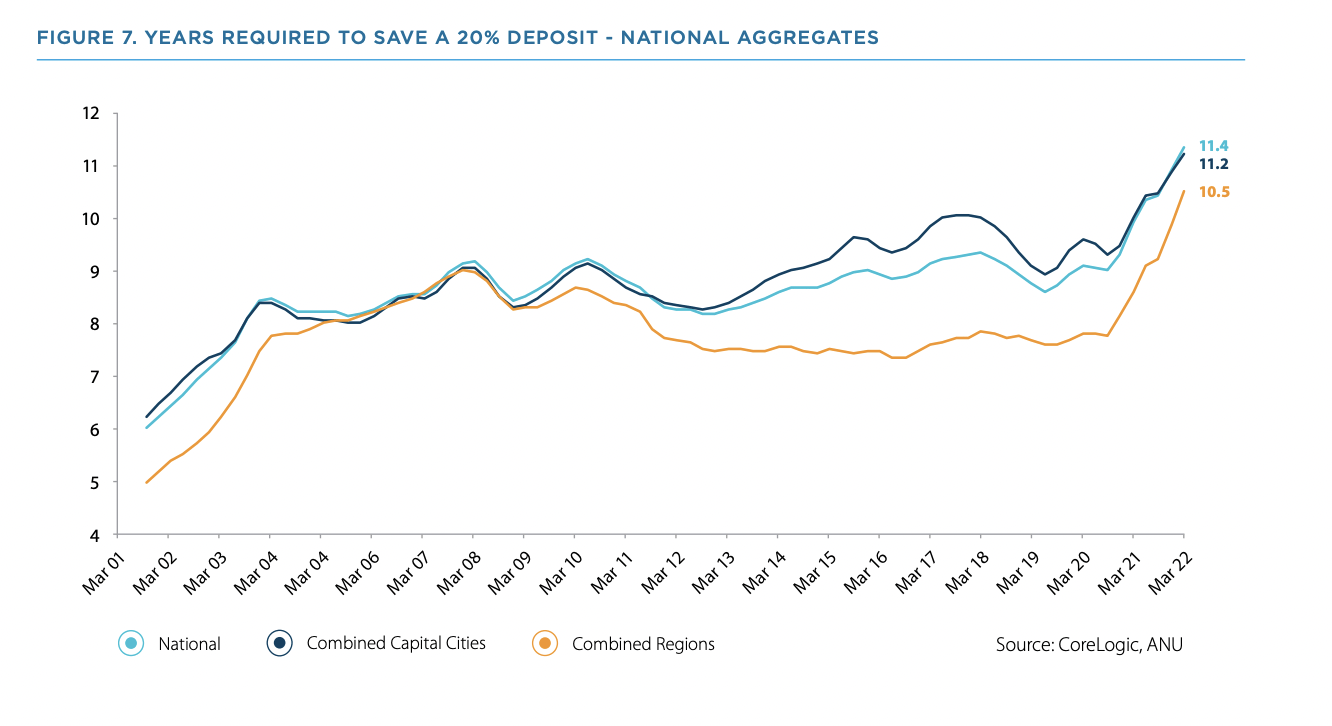

And with property price growth outstripping wage growth by such a substantial margin, the time it takes to save a 20% deposit has also increased.

In fact, it takes the average prospective homebuyer more than 11 years of saving to afford a 20% deposit nationwide, assuming a household income savings rate of 15% per annum. That’s 2.2 years longer than in March 2020.

Unsurprisingly, it takes even longer to save a 20% deposit in Greater Sydney – 14.1 years.

Again, bear in mind there are ways you can speed up the process and buy your home faster, which we’ll outline below. If you come see us at Just Imagine Finance, we’ll be happy to chat about your options.

Conditions might be changing, but challenges remain

This report predates the property market slowdown – with price growth noticeably easing, and in some locations going backwards, as rising interest rates start to bite. That suggests the situation has improved for first home buyers since the report was written, although it’s likely affordability challenges will remain for two big reasons.

Firstly, there’s the impact of the Reserve Bank’s rate rises to consider. On one hand, interest rate rises are dampening property price growth, which should shorten the time it takes to save for a deposit. On the other hand, interest rate rises will also reduce first home buyers’ borrowing power.

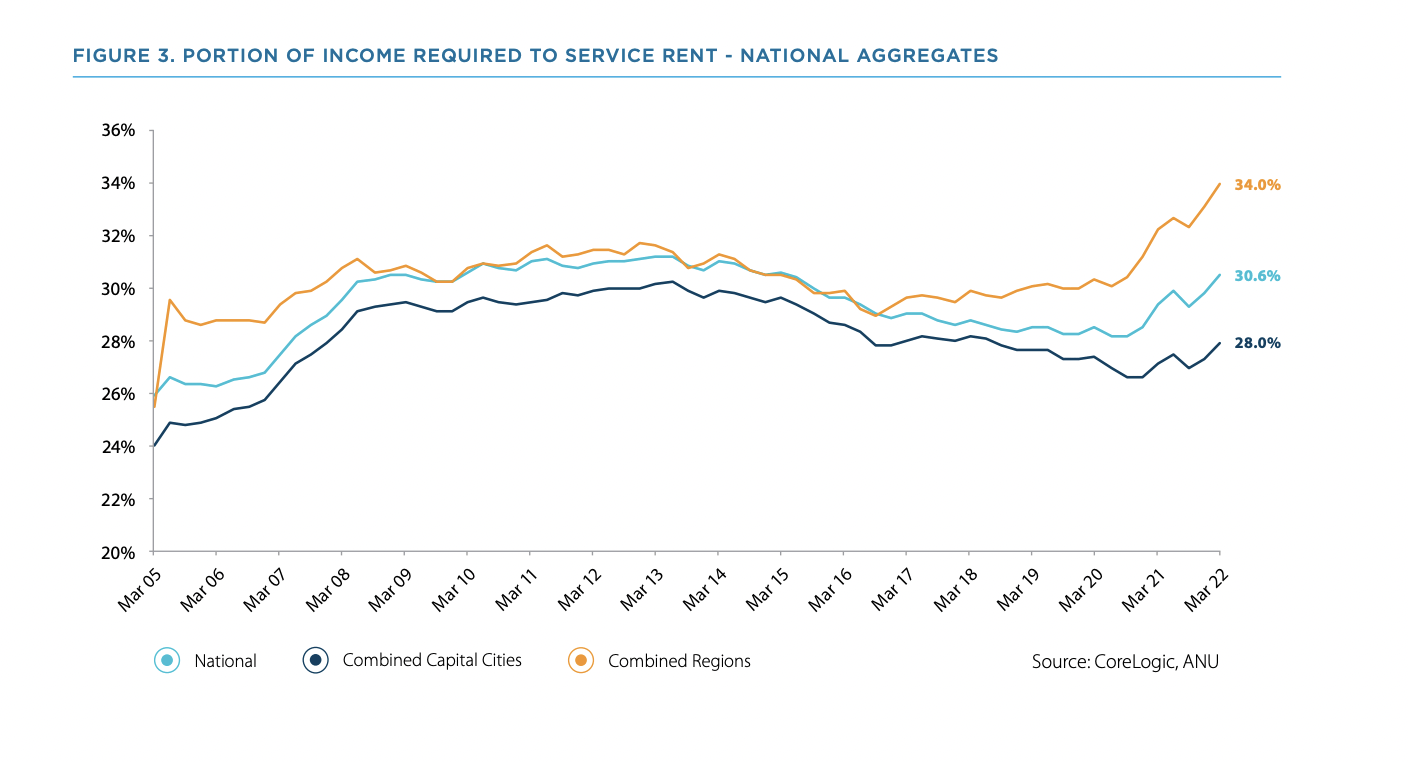

Then there’s rental affordability – because not everyone can move back in with their parents when they are saving for a deposit. Once again, it’s not great news, with Australia currently in the grip of a rental crisis, after plummeting vacancy rates sent weekly rents to record highs over the three months to June, according to CoreLogic’s quarterly rental review.

As a result, the share of income needed to service rent on a new lease will likely be higher than the 30.6% it was in March, which itself was a new record high.

Don’t want to give up on the great Australian dream just yet?

Fortunately, as mentioned earlier, there are things you can do to break into the property market faster. These include:

Taking advantage of federal and state government incentives – such as the federal government’s expanded Home Guarantee Scheme that has more spots available and updated property price caps for this new financial year- Saving a lower deposit – and paying lender’s mortgage insurance (LMI)

- Having a family member guarantee your loan – so you can avoid paying LMI

- Partnering with a friend to buy property – and boosting your borrowing power

- Rentvesting – renting in an area you want to live in, while buying in an area that suits your budget

Get expert advice

Want to get on the property ladder? Then it can pay to think of a mortgage broker as your new best friend.

That’s because a mortgage broker is a great source of expert financial advice, so they can help you crunch the numbers and give you home loan options based on your unique circumstances.

They can then guide you through the complexities of the home loan process, making it easier and less overwhelming.

If you’re a first home buyer, Just Imagine Finance can give you the expert advice you need to make an informed decision. Contact Catherine on 0414 673 359 or catherine@justimaginefinance.com.au