Government pensions and superannuation were the main sources of income for 80% of Australian retirees in the 2022-23 financial year, according to the Australian Bureau of Statistics’ latest retirement data.

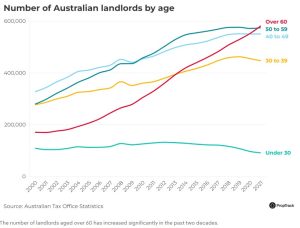

However, trends over the past 24 years show that property investment has become a growing – and valuable – strategy to boost retirement income.

In fact, in 2021, statistics from the Australian Taxation Office revealed that more than half of the country’s property investors were over the age of 50, with those over 60 accounting for the largest share of any age group.

Meanwhile, the Commonwealth Bank reports that, in 2023, Boomers (born 1955 to 1964) made up 9% of new real estate investors.

Property investment strategies

There are two main strategies when it comes to property investment:

- Generating yield through rental income

- Achieving capital growth.

While a younger investor is more likely to favour a capital growth strategy, those entering retirement will generally look to generate passive income through collecting rent.

Of course, retirees who have owned their homes for many years and no longer have mortgages can also benefit from the long-term appreciation of property values by selling them for a profit.

However, generating rental income offers a steady cash flow. This income can not only help retirees cover day-to-day living costs but also complement their superannuation and savings, allowing them to conserve their nest eggs.

Furthermore, having this ongoing income stream can act as a safety net, providing financial stability during retirement.

Establishing a passive income stream

Getting to this point, though, is not as simple as merely purchasing a property and waiting for it to generate income; it involves careful selection, upfront work and ongoing management.

To maximise your rental income during retirement, it is important to follow these guidelines:

1. Invest in prime locations

Properties near schools, hospitals, retail facilities and public transport are highly desirable, ensuring low vacancy rates and steady rental income.

2. Select tenant-friendly properties

Focus on properties that meet the needs of local renters, such as family homes in suburbs or apartments close to business hubs. Features like modern amenities and convenient access to services help attract long-term tenants.

3. Take advantage of tax benefits

As a property investor, you can benefit from tax deductions on home loan interest, property management fees and maintenance costs.

4. Ensure steady cash flow

Look for properties with strong rental yields and consistent demand to reduce vacancy risk. Raising rents in line with the market also helps boost income during retirement.

5. Consider using professional property management

You can choose to self-manage your property, but hiring a property manager can be beneficial. Professional management helps to ensure the property is well-maintained and that tenants are carefully managed. This reduces stress and can protect your rental income.

6. Plan for long-term success

Factor in all costs, such as stamp duty, maintenance and repairs, and maintain a financial buffer for unexpected expenses. Holding the property long-term increases your chance of capital growth, which can further support your retirement income.

7. Stay informed

Keep track of market trends and regularly seek professional advice to ensure that you are making informed decisions about rent adjustments or potential sales.

Building financial security in retirement

The most recent ASFA Retirement Standard for the June 2024 quarter states that retirees aged 65 to 84 looking to live comfortably require an annual household budget of $73,300 for couples and $52,100 for singles

To live modestly, retirees aged around 85 require an annual household budget of $67,600 for couples and $48,900 for singles.

Retirement income doesn’t have to be limited to superannuation or government pensions. In fact, a solid retirement strategy should always involve a good level of diversification and access to liquid capital when needed.

Investing in assets such as residential or commercial property can help fund your retirement as these assets can offer rental income and the potential for value appreciation.

Whether you are looking to purchase a home that will help you achieve long-term capital growth, invest in one rental property, or start building a portfolio, Just Imagine Finance can help you secure a mortgage. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.