The path to home ownership just became clearer for thousands of Australians, thanks to the expanded Home Guarantee Scheme. Now rebranded as the Australian Government 5% Deposit Scheme, the initiative makes it easier for both first home buyers and single parents to enter the market sooner.

The expanded scheme offers unlimited places, removes income caps and raises property price thresholds to reflect current market conditions. That means eligible buyers can purchase a home with a smaller deposit and without paying lender’s mortgage insurance (LMI), a saving that can amount to tens of thousands of dollars. The federal government backs up to 18% of the loan under the 2% option, meaning the lender sees lower risk, which helps you avoid this costly LMI.

More opportunities for single parents

For single parents, the changes also extend access to the 2% deposit option, removing previous income and place limits that often stood in the way. Eligible applicants include single parents or legal guardians who haven’t owned a home in the past 10 years, giving many the chance to enter, or re-enter, the property market.

Eligibility criteria

To qualify, applicants must be Australian citizens or permanent residents aged 18 or older, applying as the sole borrower and living in the property as their main home. The 2% pathway can be used to buy most property types, including existing homes, townhouses, apartments, house-and-land packages or off-the-plan builds (conditions apply).

While the government guarantee supports the lender, borrowers remain responsible for the full loan and repayments. This means lenders will still assess income, credit history and borrowing capacity before approving finance.

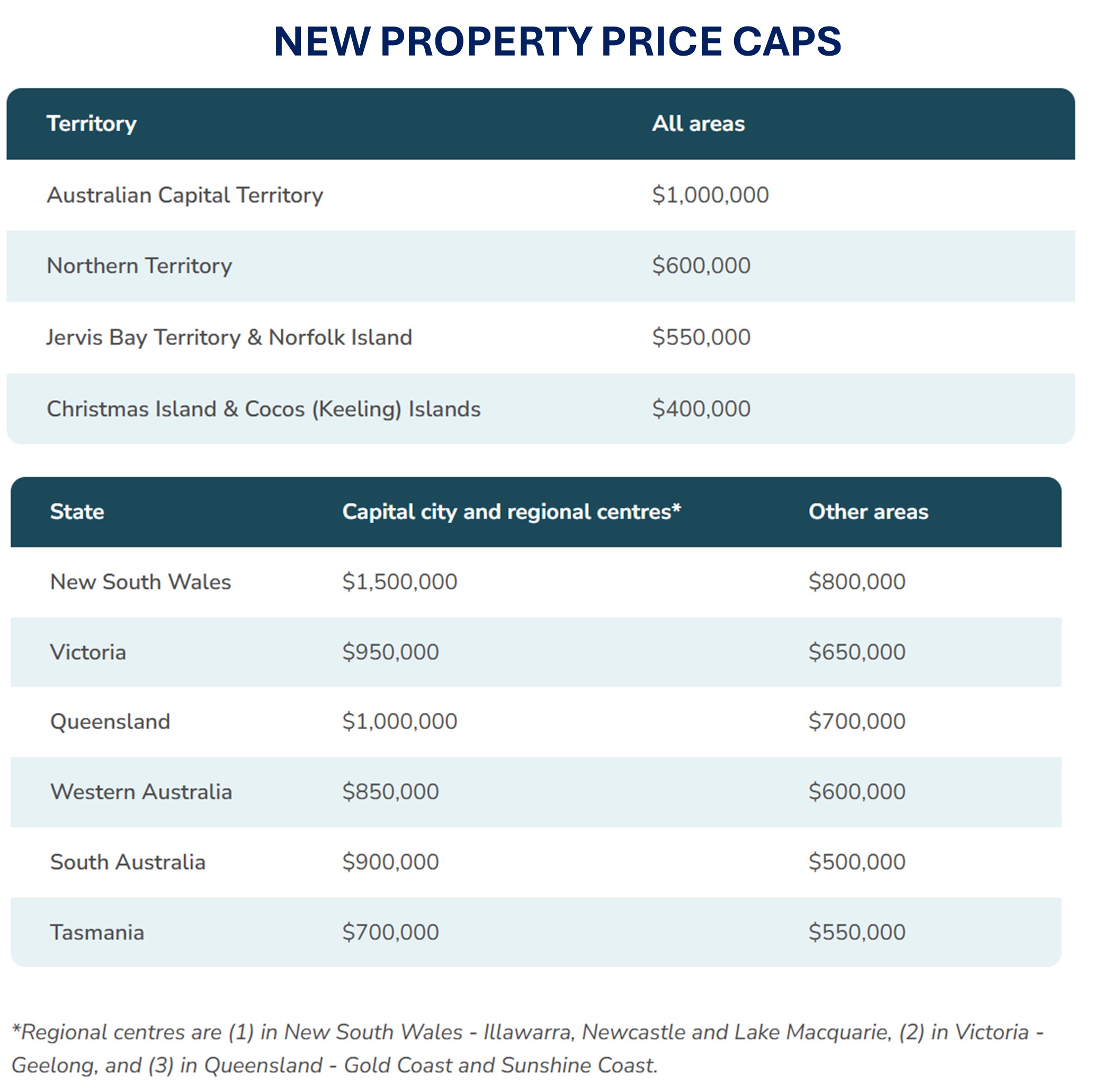

Importantly, properties must fall within the updated regional price caps. With fewer restrictions and greater flexibility, the scheme gives single parents a practical path to home ownership and long-term stability for their families.

Flexibility for those with family support

Even with the lower deposit options, saving can still be a challenge. The good news is that several participating lenders recognise that financial help often comes from family. A cash gift from parents or close relatives can count toward your deposit, provided it’s unconditional and supported by a signed letter confirming it doesn’t need to be repaid.

That said, lenders still need to be confident you can meet repayments. A rental payment history – ideally through a licensed real estate agent – can often serve as proof of repayment ability. If you’ve been paying rent on time for at least six months, that record can strengthen your application and help demonstrate genuine repayment capacity.

Because policies vary between lenders, working with a broker like Just Imagine Finance can make all the difference. We’ll help identify which lenders accept gifted deposits or rent history as part of your eligibility. The right guidance could be the difference between waiting years and owning your own home sooner.

A simpler way to start

With unlimited places, higher property caps and expanded lender participation, the 5% deposit scheme is now one of the most accessible government housing initiatives in Australia. For single parents, these updates turn what once felt out of reach into a real opportunity.

Whether you’re a single parent exploring the 2% deposit option, a first home buyer looking to enter the market sooner, or simply want to understand your eligibility under the Australian Government 5% Deposit Scheme, Just Imagine Finance can guide you through the process. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.