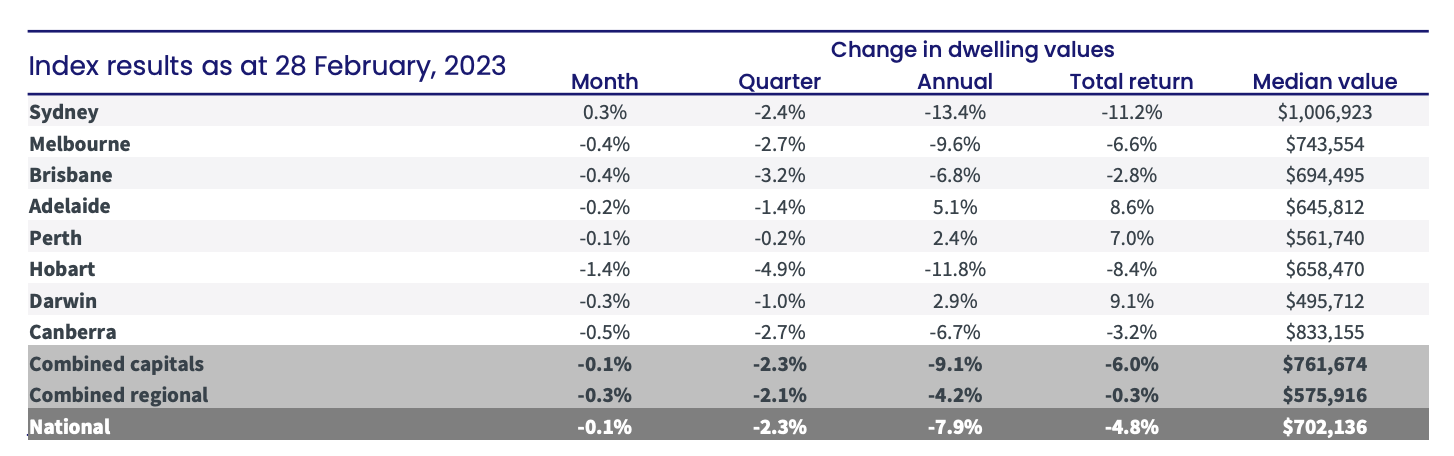

The last year has been challenging for many of Australia’s property markets as skyrocketing interest rates reduced Australians’ borrowing capacity and dampened demand.

But there are now signs the slump is easing after CoreLogic’s national home value index only fell 0.14% over February, the smallest monthly fall since the Reserve Bank of Australia started lifting interest rates in May 2022.

The national result was driven by Sydney, where home values rose for the first time since January 2022, with a 0.3% monthly gain.

In all the other capitals (except Hobart), price declines eased, with values falling by less than 0.5%.

This begs the question: why is the downturn easing, given that interest rates are still rising?

Supply not meeting demand

CoreLogic’s research director, Tim Lawless, said the stabilisation in housing values over the month coincided with a collapse in the number of new homes listed on the market.

“The past four weeks have seen the flow of new capital city listings tracking -17.0 per cent lower than a year ago and -11.9 per cent below the previous five-year average,” he said.

“This trend towards a below-average flow of new listings has been evident since September last year, coinciding with a loss of momentum in the rate of value decline.”

But while prospective vendors are prepared to wait out the downturn, the estimated volume of sales recorded a strong seasonal rebound in February.

As a result, supply isn’t quite meeting demand, putting a floor under price falls.

It gets even more interesting when you look at auction clearance rates, which also bounced back in February, with the capital city weighted average percentage reaching the high 60s through the second half of the month.

Sydney’s auction results were even more impressive, with clearance rates rising to above 70% in the week ending 19 February, for the first time since February 2022 (when prices were at record highs).

This is important as an auction clearance rate of:

- Between 60-69% is considered a sign of a balanced market, reflecting stable home prices

- Less than 60% indicates a buyer’s market, suggesting price falls ahead

- 70% or more indicates a seller’s market, suggesting price gains ahead

Where to now for Sydney property prices?

While February’s price gain in Sydney is noteworthy, it’s too early to conclude the downturn is over, particularly with the RBA raising interest rates again in March.

That said, that doesn’t mean green shoots aren’t visible.

For one thing, RBA governor Philip Lowe hinted the end of interest rate hikes could be in sight during a speech at the Australian Financial Review business summit, saying “we are closer to the point where it will be appropriate to pause interest rate increases to allow more time to assess the state of the economy.”

For another, the NSW government’s First Home Buyer Choice scheme is fuelling interest in

properties priced under $1.5 million, with Domain data showing the proportion of searches for properties up to $1.5 million jumped 6.3 percentage points to 74.4% in February compared with a year ago.

There’s also a good chance property investors will return, tempted by strong market conditions that have seen rents rise at an annual rate of 29.6% for the week ending 12 February, according to SQM Research.

Whether you’re buying your first or second home to live in or rent out, Just Imagine Finance can help you get the right home loan. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.