The rental market is extremely tight, with tenants struggling to find accommodation and rents rising month by month. That is producing three major dynamics.

The first is that renters are being put under pressure to find affordable accommodation. The second is that many renters are looking to purchase their first home, and are even open to buying with a friend or family member. The third dynamic, which is the flip side of the first, is that property investors are controlling the rental market.

Before we explain why, let’s explore the data.

Vacancy rates (which capture the share of empty rental properties) are historically low right now, according to SQM Research. In December, vacancy rates were just 1.7% for Greater Sydney and 1.3% for the Blue Mountains. To put that into perspective, anything below 2% is a landlord’s market; 2-3% is a balanced market; and anything above 3% is a tenant’s market.

The best way to think about a rental market with few available properties is that there’s a shortage of supply – and as with any market, when supply goes down, demand goes up. Hence the ongoing increases in rents, to record levels.

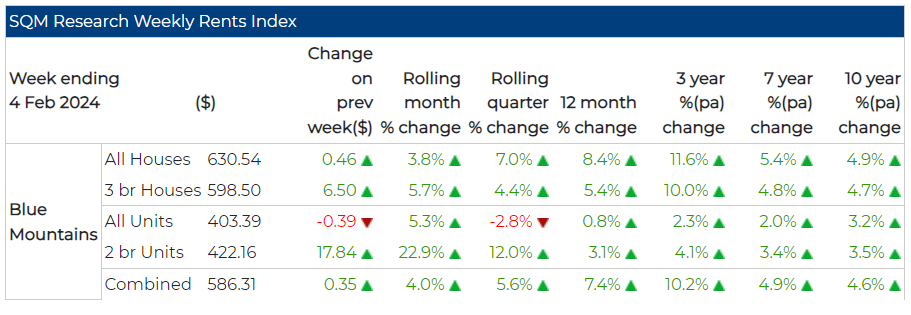

In Greater Sydney, the median weekly rent jumped 14.3% in the year to February 4, according to SQM Research. In the Blue Mountains, it increased 7.4% (see table below).

Rental supply struggling to keep up with demand

If you’re wondering why there’s a shortage of rental accommodation, it once again goes back to supply and demand.

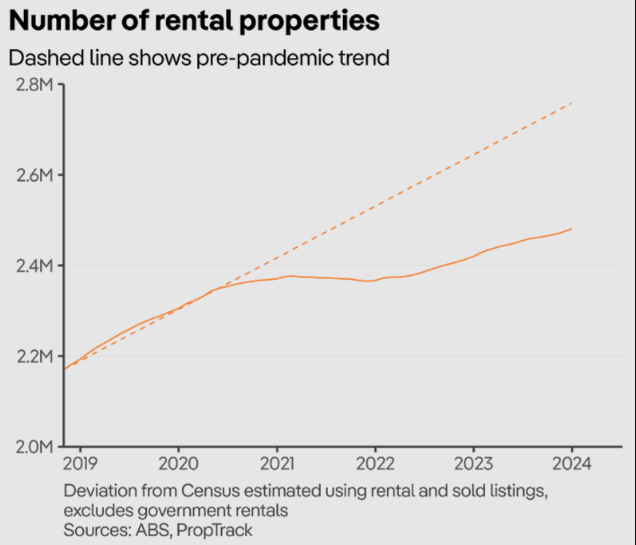

Across Australia, rental supply fell in 2021 and then increased by little more than 2% in both 2022 and 2023, according to PropTrack senior economist Paul Ryan.

“While this outcome was much better than the fall in 2021, this growth remains far below the rate seen before the pandemic. And this rate has clearly not been fast enough to prevent the rapid rent increases that have been experienced recently. Slower growth in the number of rental properties since the pandemic has left the total number of rental properties more than a quarter of a million homes below where pre-pandemic growth rates would have put them,” he said.

Meanwhile, this dearth in supply has coincided with an explosion in demand.

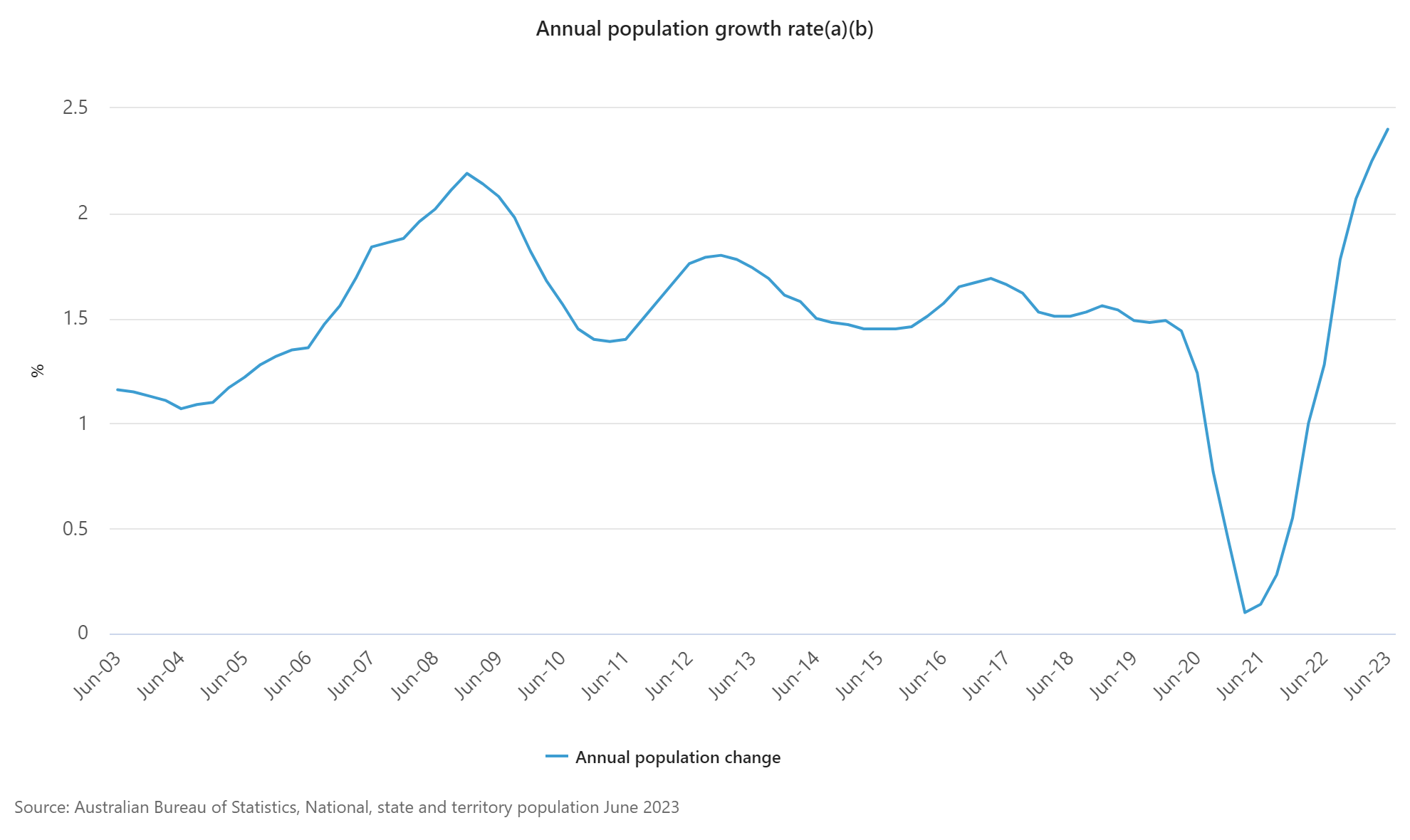

Australia’s population is currently experiencing its strongest growth since the 1970s.

The national population rose 2.4% (or 624,000 people) in the year to June 2023, according to the most recent data from the Australian Bureau of Statistics. That compares to a 20-year average of 1.5%.

All those people need somewhere to live, but supply is not growing as quickly as demand.

Why now might be a good time to buy

If you’re a property investor, this is good news, because rents keep rising and it’s relatively easy to find quality tenants for your property.

Even better, property prices have been rising strongly too. In the year to February 6, asking prices on for-sale properties rose 10.6% for Greater Sydney and 8.9% for the Blue Mountains, according to SQM Research.

That’s why, if your financial circumstances allow, now might be a good time to purchase an investment property. If you don’t have the cash to fund the deposit on an investment property, you could potentially use equity instead.

Just Imagine Finance can help you buy an investment property. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.