Two years ago, the current property boom seemed unimaginable, with the news filled with grim forecasts about property crash of epic proportions.

After all, many analysts thought Australia’s population growth was driving demand for residential property. So closing the international border to non-residents – as we did on 20 March 2020 – would surely cause dwelling values to tumble, right?

But as we now know, it proved to be a bit more complicated than that. Because while property prices initially declined, record-low interest rates and an imbalance between supply and demand caused values to skyrocket.

Pre-pandemic, in February 2020, the national median dwelling price was $550,000, according to CoreLogic. Two years later, the median value has jumped by 32.4% to hit $728,000.

Meanwhile, in Katoomba, the median asking price for houses soared by a stunning 42.4% to $968,000 over the same timeframe, according to SQM Research.

Closed borders and the inner cities

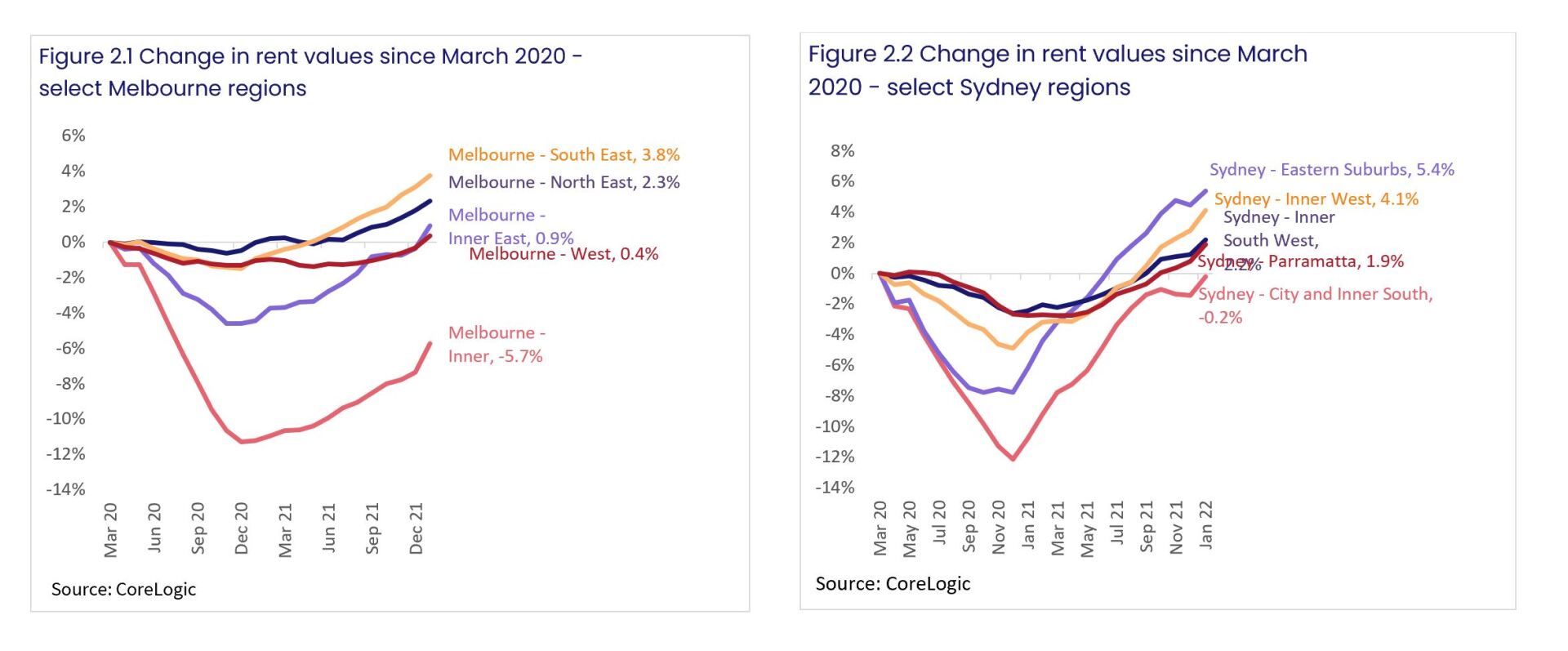

That’s not to say slamming the border shut didn’t have a negative impact. It did – though this has predominantly been concentrated in Sydney and Melbourne’s CBD unit markets.

The pandemic hit inner-city landlords hard, as both overseas students and tourists disappeared. Weekly rents went into freefall as vacancy rates spiked.

But it’s not all bad news – as both Sydney and Melbourne’s CBDs have staged something of a comeback in recent months.

You can see this in the charts below.

It’s likely Australia’s reopening will add further fuel to the fire.

In fact, it already has – as international students, permanent residents and Australian citizens have already been welcomed back since November 2021.

Accordingly, overseas arrivals totalled 195,760 through December 2021 (up from 34,670 arrivals the year before).

And you clearly see the impact of these arrivals on rental demand.

Australia is “on the verge” of a rental crisis: Domain

Take Domain’s February 2022 vacancy rate report, for starters.

This found national vacancy rates are at the lowest point on record, at an incredibly tight 1.1%.

Every capital city saw a drop in vacancy rates – except for Adelaide and Hobart (which remained steady at historic lows). Sydney and Melbourne saw the biggest falls with:

- Sydney’s rental market hitting its lowest point since November 2017, at 1.7%

- Melbourne’s landlords enjoying the lowest vacancy rate since March 2020, at 2.1%

What’s more, Domain warned that Australia was “on the verge” of a rental crisis – with demand expected to sharply rebound following the full reopening of international borders.

“Given Sydney and Melbourne have historically welcomed more overseas migrants, as well as being popular tourist destinations, demand for rentals will continue to spiral. This will also be the case for Australia’s other typical tourist hotspots,” Domain noted.

Katoomba’s rental market is already incredibly tight, with a vacancy rate of just 0.5% in January 2022 – the most recent data available. As a result, weekly house rents have been under sustained upward pressure, climbing by 7.9% over the 12 months to 4 March 2022.

Looking to buy an investment property? Just Imagine Finance has helped many investors over the years. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.