Against the backdrop of surging inflation, the Reserve Bank of Australia lifted the cash rate by 25 basis points to 0.35%.

While it’s the first time in more than a decade that the cash rate target has increased, RBA governor Philip Lowe warned more hikes are on the horizon.

“The board is committed to doing what is necessary to ensure that inflation in Australia returns to target over time,” he said.

“This will require a further lift in interest rates over the period ahead. The board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.”

Within a day of the RBA’s move, Australia’s four biggest banks announced they would pass on the cash rate hike in full to their variable borrowers. At the same time, many smaller lenders also followed suit.

As a result, the average borrower with a $500,000 variable rate loan and 25 years remaining will see their repayments rise by $65 a month, according to RateCity calculations.

Someone with a $1 million loan will see their repayments rise by $130.

What about fixed-rate borrowers?

Historically, fixed-rate loans make up about 15% of the Australian mortgage market.

However, that all changed during the pandemic, when Australians rushed to lock in some staggeringly low rates. This rush peaked in July 2021, when 46% of all new home loans were fixed.

If you are on a fixed-rate mortgage, you can breathe easy – at least for now – as you’ll be protected against any interest rate rises for the period of your fixed-rate term.

But your loan’s fixed interest terms will inevitably end. This, of course, begs the question: what happens then?

Your options when your fixed term ends

You have several options once your fixed-rate term comes to an end:

- Do nothing – and revert to your lender’s standard variable rate

- Refinance your home loan

- Refix your home loan

Let’s look at what happens if you do nothing.

In this case, your lender will move you onto their standard variable rate (SVR), which will almost certainly be higher than the discounted variable rate they’ll be offering to new borrowers.

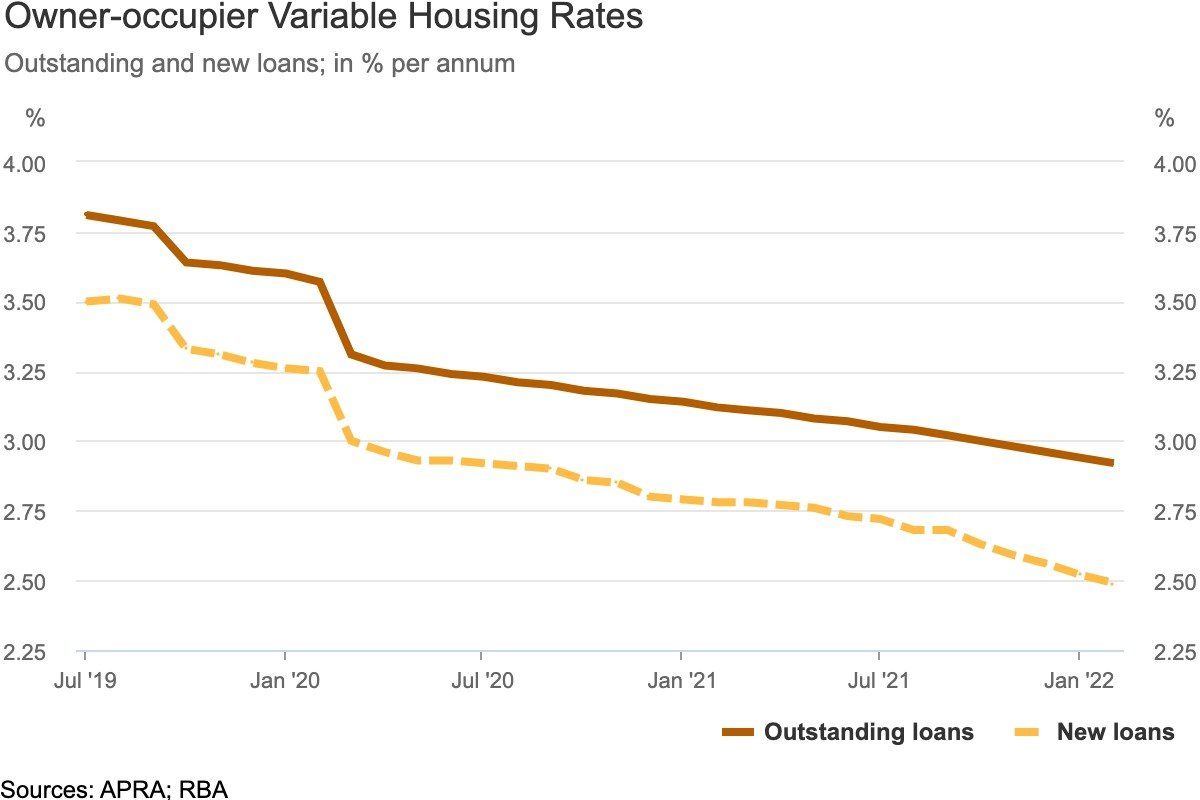

That’s because Australian homeowners often pay a loyalty tax for sticking with their lender – with RBA data showing interest rates on existing home loans are currently 43 basis points higher, on average, than they are on new loans.

As a result, doing nothing can end up with you paying thousands of dollars more each year than you need to. Ouch.

What about refinancing?

You can avoid the loyalty tax by refinancing onto a lower rate than your lender’s SVR. That’s not the only reason to switch though. That’s because there’s a good chance your circumstances will have changed since you first took out your fixed home loan – whether that’s a new job, higher salary or baby on its way. As a result, you may be able to refinance onto a loan that’s more suited to your financial requirements.

Keep in mind, though, that refinancing does come with costs attached and isn’t suitable for every borrower.

Refixing your loan onto a new rate

Your final option is to refix your home loan, which will give you the predictability that comes with a fixed-rate loan.

Bear in mind, though, that many experts are predicting several rate rises in the next few years, so your next fixed rate might not be as low as your current one. Also, fixing might not be suitable if you want to make additional repayments or take advantage of an offset account.

Not sure what to do after your fixed period ends?

After years of making the same repayments, It can be challenging to work out what your next move is – particularly if the market has significantly changed since you fixed your home loan.

An expert mortgage broker like Just Imagine Finance can help you review your financial situation and weigh up your options, answering any questions you may have. Once we’ve identified which option would best suit your situation, we can assist you with refinancing or refixing your home loan.

Fixed-rate term ending? At Just Imagine Finance, we can help you weigh up your options so you get a new home loan that’s suited to your needs. Contact us on catherine@justimaginefinance.com.au or 0414 673 359.