Without a doubt, 2022 has been a rollercoaster year for many of Australia’s property markets. Earlier in the year, property values reached record highs, before multiple interest rate hikes and surging inflation sent prices tumbling.

But as the dust settles on the year that was, you might be wondering what’s in store for the next 12 months.

Well, in good news, Australia’s property market could stage a remarkable recovery, with national price growth of up to 7%, according to SQM Research’s Housing Boom and Bust Report.

However, that ‘base case’ scenario assumes three things:

- The Reserve Bank of Australia keeps the cash rate below 4%

- Annual inflation peaks at 8%, before dropping to 5%

- Unemployment stays below 5%

At the time of writing:

- The cash rate is at a 10-year high of 3.10%, following eight consecutive rate rises since May

- Annual inflation is 6.9% (and forecast to peak at 8% at the end of December)

- Unemployment is 3.4%

Sydney to lead the recovery

If this base case scenario pans out, Sydney will see the sharpest gain of any capital city, with property prices jumping up to 9%, thanks to a huge rise in overseas arrivals, the return to the office and the NSW government’s stamp duty reform.

Perth is tipped to rank second, with prices forecast to climb up to 8%, fuelled by strong rises in employment and interstate migration.

Melbourne and Brisbane would also see a modest recovery, with prices in both cities expected to rise between 1% to 5%.

Prices in Adelaide could stay flat or see growth of up to 5%.

At the other end of the scale are Canberra, Hobart and Darwin, with prices in these cities potentially falling further throughout the next 12 months.

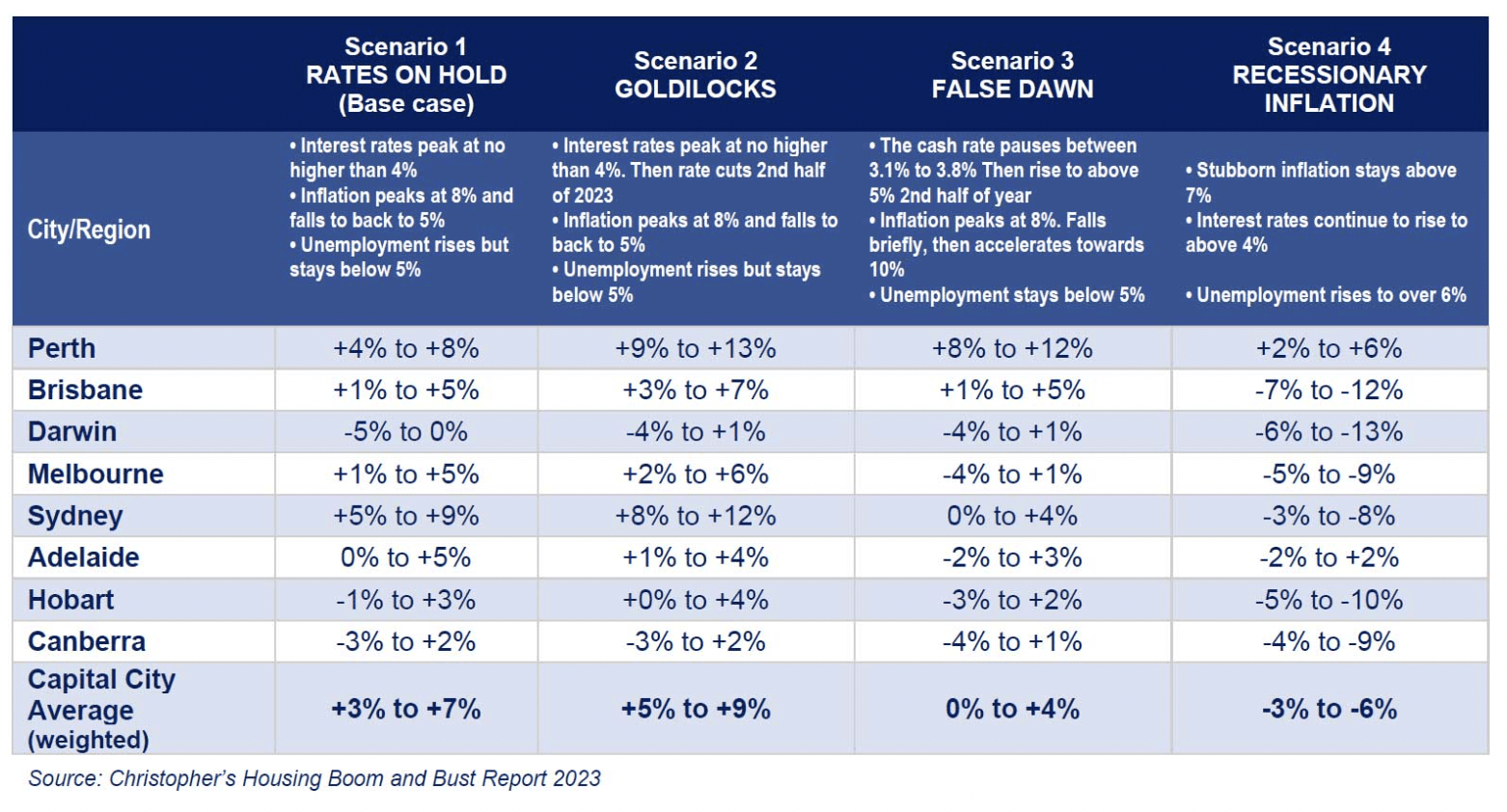

As the image above shows, the report also models three other scenarios:

- Goldilocks – in which the combined capital city average would see gains of up to 9%, led by double-digit increases in Sydney and Perth

- False dawn – in which the combined capital city average would see gains of up to 4%, with only Perth and Brisbane being immune to price falls

- Recessionary inflation – in which only Perth would avoid property price falls

Why Australian property remains a sound investment

As Mark Twain famously said: “It’s difficult to make predictions, especially about the future.” So only time will tell if SQM Research’s forecast is accurate.

That said, the history of Australian property is that it produces strong returns over the long-term, despite the short-term downturns that occur from time to time.

For example, the national median property price increased by an extraordinary 382% over the 30 years to July 2022, according to CoreLogic.

Thinking of buying a property in 2023? Whether you’re buying your first or second home to live in or rent out, Just Imagine Finance can help you get the right home loan. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359