Are you considering buying property? If so, you may want to act quickly.

That’s after a recent KPMG forecast predicted that home prices in Sydney and across Australia are set for a substantial rise in the coming years.

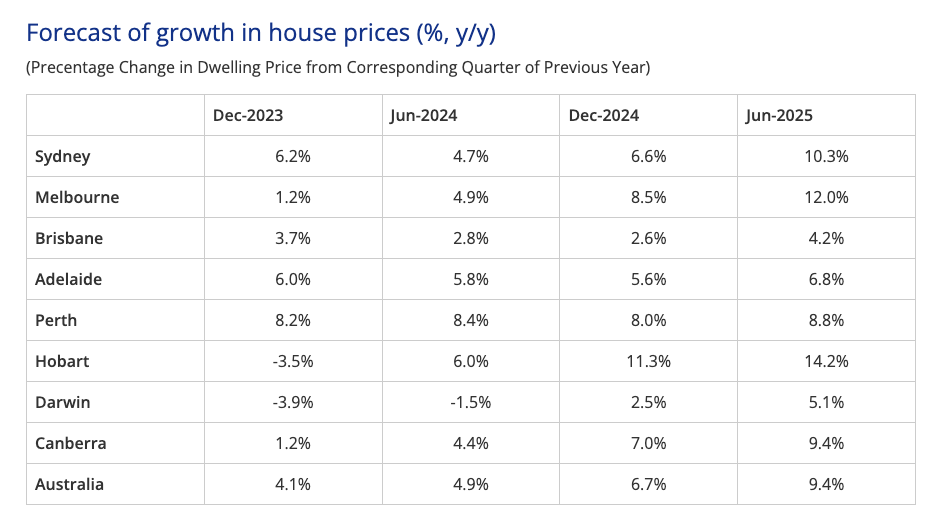

Specifically, the accountancy firm expects house prices to increase nationally by 4.9% over the next eight months, before accelerating 9.4% in the 12 months to June 2025.

As the table below shows, in Sydney, the rise is forecast to be 4.7% by June 2024 followed by a 10.3% surge in the 12 months to June 2025.

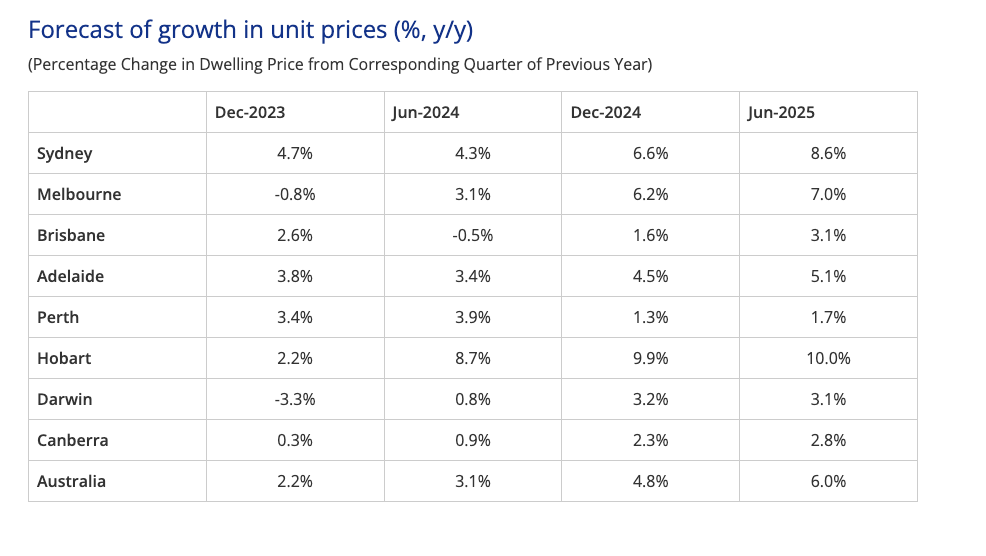

Apartment prices are expected to follow suit, albeit at a slightly slower rate with KPMG expecting prices to increase:

- Sydney = 4.3% by June 2024 and 8.6% by June 2025

- Nationwide = 3.1% by June 2024 and 6.0% by June 2025

What’s driving the increases?

KPMG chief economist Dr Brendan Rynne said there were several factors expected to push up prices. On the demand side, these include:

- Heavier migration: Migration numbers are bouncing back. More people coming into the country means more demand for housing, adding strain to an already tight property market.

- Anticipated rate cuts: The major banks have forecast up to five interest rate cuts between 2024 and 2025. Lower rates make borrowing cheaper, likey attracting more homebuyers.

- High rental costs: As renting becomes increasingly expensive, it’s pushing renters to explore homeownership instead, further increasing demand.

- Relaxed lending conditions: KPMG believes there’s a possibility that lending conditions will ease, making it simpler for buyers to secure loans.

- Foreign investor demand: Foreign investor demand is rebounding, with the Treasury’s latest Foreign Investment Quarterly Report showing $7.9 billion worth of Australian real estate was purchased in the 2023 financial year.

- Work-from-home trend: The post-pandemic environment has normalised remote working, creating a long-term demand for larger living spaces. This change in lifestyle preferences further elevates property prices.

On the supply side, various constraints are also putting upward pressure on property prices:

- Scarcity of land: Available land for new builds is limited, especially in metropolitan areas. Scarcity inevitably pushes up prices.

- Falling approval levels: Building approvals have seen a marked decline with recent Australian Bureau of Statistic’s data showing a 22.9% year-on-year fall in August 2023. Reduced rates of building approvals mean fewer new homes and units will be hitting the market.

- Slower construction: Construction activity has been hindered by rising material costs and delays, further reducing the rate at which new homes are built.

All these factors add up to create a seller’s market, where the number of buyers exceeds the available homes.

While KPMG’s report said there were some factors exerting downward pressure on prices, it concluded that the supply/demand imbalance would ultimately outweigh them.

Looking to buy property? Just Imagine Finance can help you get finance whether you’re a property investor, first home buyer or want to upgrade your home. To get started, contact us on catherine@justimaginefinance.com.au or 0414 673 359.