High interest rates usually put the brakes on the property market, cooling demand and keeping prices in check. But in Australia, the opposite has happened.

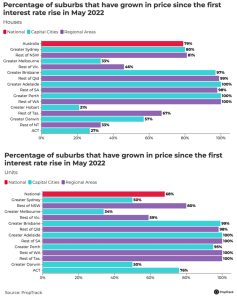

According to PropTrack, property prices climbed in most Australian suburbs over the 31 months from May 2022—despite 13 rate hikes that pushed the cash rate to 4.35%. By the end of 2023, median house values had surpassed pre-hike levels in 80% of suburbs, while unit prices rose in 68%.

Some regional areas saw price growth in every suburb, as shown in the graph below.

So why have property prices remained so strong?

The simple answer: demand is outstripping supply. Australia’s housing shortage has outweighed the impact of higher interest rates, keeping upward pressure on prices.

What happens when rates start falling?

While high interest rates typically lead to lower property prices, it follows that lower interest rates generally drive home values higher.

In February, the Reserve Bank of Australia (RBA) lowered the cash rate by 0.25 percentage points to 4.10% to stimulate the economy amid easing inflationary pressures.

This move is expected to enhance borrowing capacity and improve property market sentiment, leading to increased demand and potential upward pressure on property prices.

Therefore, if you’re in a position to purchase property, acting sooner rather than later could be advantageous.

Why you shouldn’t worry too much about higher property prices

If you plan to buy this year but cannot do so before prices start rising, there is good news: the increases are not predicted to be significant.

CoreLogic head of research Eliza Owen said sellers expecting a surge in home values and the number of sales due to interest rate reductions might need to adjust their expectations. This is because, even with lower mortgage rates, the national median home value of $815,000 remains beyond the borrowing capacity of many households.

“Last year, Australia’s property market went up by 4.9% in value. We don’t have an exact forecast number for 2025, but we’re anticipating that it will be weaker than in 2024. Part of that is because we expect the first few months of 2025 to actually be a downswing for the property market, and we already saw that downswing start in December.”

She said the weaker economy may also lead to an increase in the unemployment rate, which would depress property prices. And while interest rates may fall, they still remain relatively high.

Sydney property price outlook

Sydney’s property market is expected to remain relatively subdued this year, as high prices limit the impact of potential rate cuts. Unlike other cities that saw price corrections when rates rose, Sydney’s values held steady – making a sudden, rate-driven surge less likely.

This means buyers may still have opportunities to enter the market without facing rapid price increases.

That said, thanks to the RBA’s February rate cut, Sydney’s downturn may end sooner than expected, with prices stabilising before an upswing later in the year..

In fact, KPMG predicts Sydney will be one of two capitals leading price growth in 2025, with values set to rise by 3.3%—up from a 2.5% gain in 2024. By 2026, they’re forecast to climb 7.8%, the strongest growth of all capitals.

Whether you are looking to purchase a home that will help you achieve long-term capital growth, invest in your first rental property, or start building a portfolio, Just Imagine Finance can help you secure a mortgage. To discuss your options, contact us on catherine@justimaginefinance.com.au or 0414 673 359.